Home /

Expert Answers /

Accounting /

firefly-corporation-is-a-c-corporation-freya-owns-all-of-the-stock-during-the-current-year-firefly-pa497

(Solved): Firefly Corporation is a C corporation. Freya owns all of the stock. During the current year Firefly ...

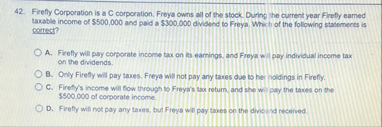

Firefly Corporation is a C corporation. Freya owns all of the stock. During the current year Firefly eamed taxable income of

$500,000and paid a

$300,000dividend to Freya. Which of the following statements is comect?

?A. Firefly will pary corporate income tax on is earnings, and Freya wa pay individual income tax on the dividends.

?B. Orly Firetty will pay taxes. Freya will not pay any taues due to her roldings in Firefly. C. Firefy's income will flow through to Freya's tax return, and she wil pay the taxes on the

$500,000of corporate income.

?D. Firefly will not pay any taxes, but Freya will pay taxes on the divicind received.