Home /

Expert Answers /

Economics /

monopoly-firms-have-downward-sloping-demand-curves-and-they-can-sell-as-much-output-as-they-desire-pa677

(Solved): Monopoly firms have downward-sloping demand curves and they can sell as much output as they desire ...

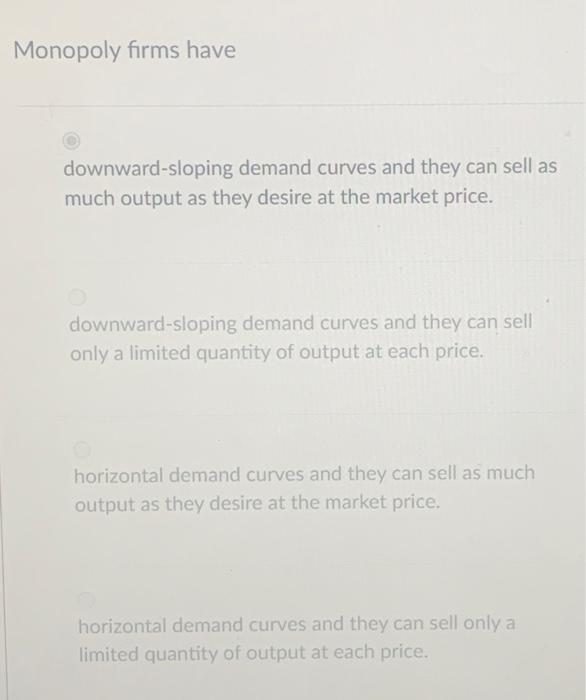

Monopoly firms have downward-sloping demand curves and they can sell as much output as they desire at the market price. downward-sloping demand curves and they can sell only a limited quantity of output at each price. horizontal demand curves and they can sell as much output as they desire at the market price. horizontal demand curves and they can sell only a limited quantity of output at each price.

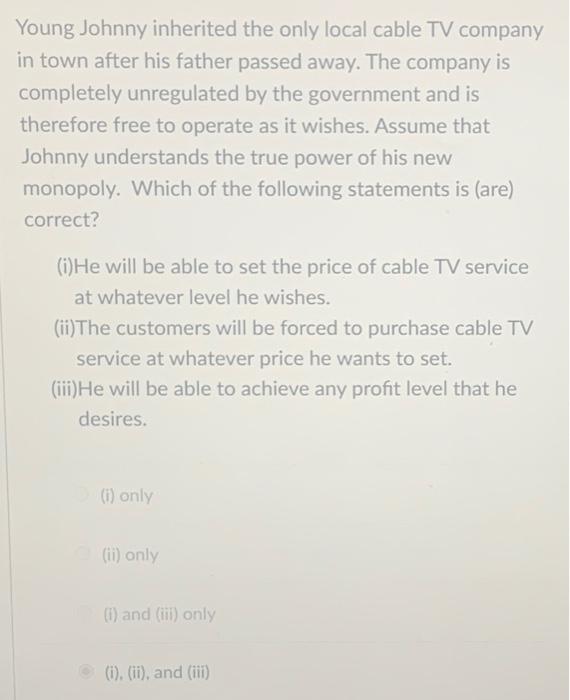

Young Johnny inherited the only local cable TV company in town after his father passed away. The company is completely unregulated by the government and is therefore free to operate as it wishes. Assume that Johnny understands the true power of his new monopoly. Which of the following statements is (are) correct? (i) He will be able to set the price of cable TV service at whatever level he wishes. (ii) The customers will be forced to purchase cable TV service at whatever price he wants to set. (iii) He will be able to achieve any profit level that he desires. (i) only (ii) only (i) and (iii) only (i), (ii), and (iii)

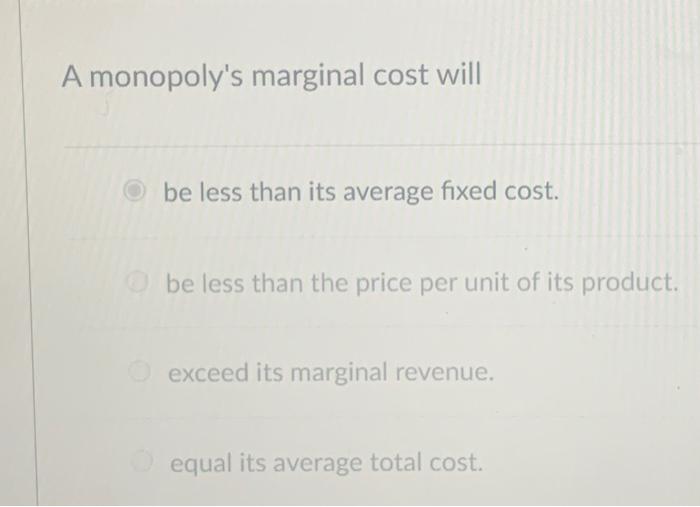

A monopoly's marginal cost will be less than its average fixed cost. be less than the price per unit of its product. exceed its marginal revenue. equal its average total cost.

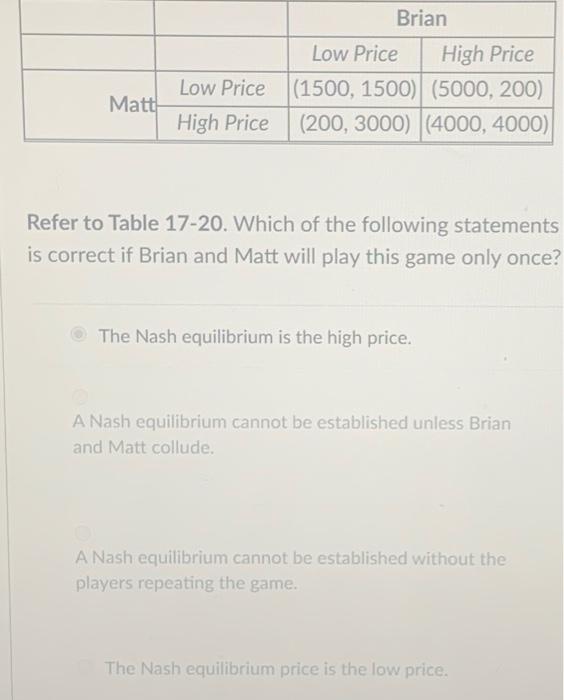

Refer to Table 17-20. Which of the following statements is correct if Brian and Matt will play this game only once? The Nash equilibrium is the high price. A Nash equilibrium cannot be established unless Brian and Matt collude. A Nash equilibrium cannot be established without the players repeating the game. The Nash equilibrium price is the low price.