(Solved): The trial balance of Kirigbird Wholesale Company contained the following accounts shown at December ...

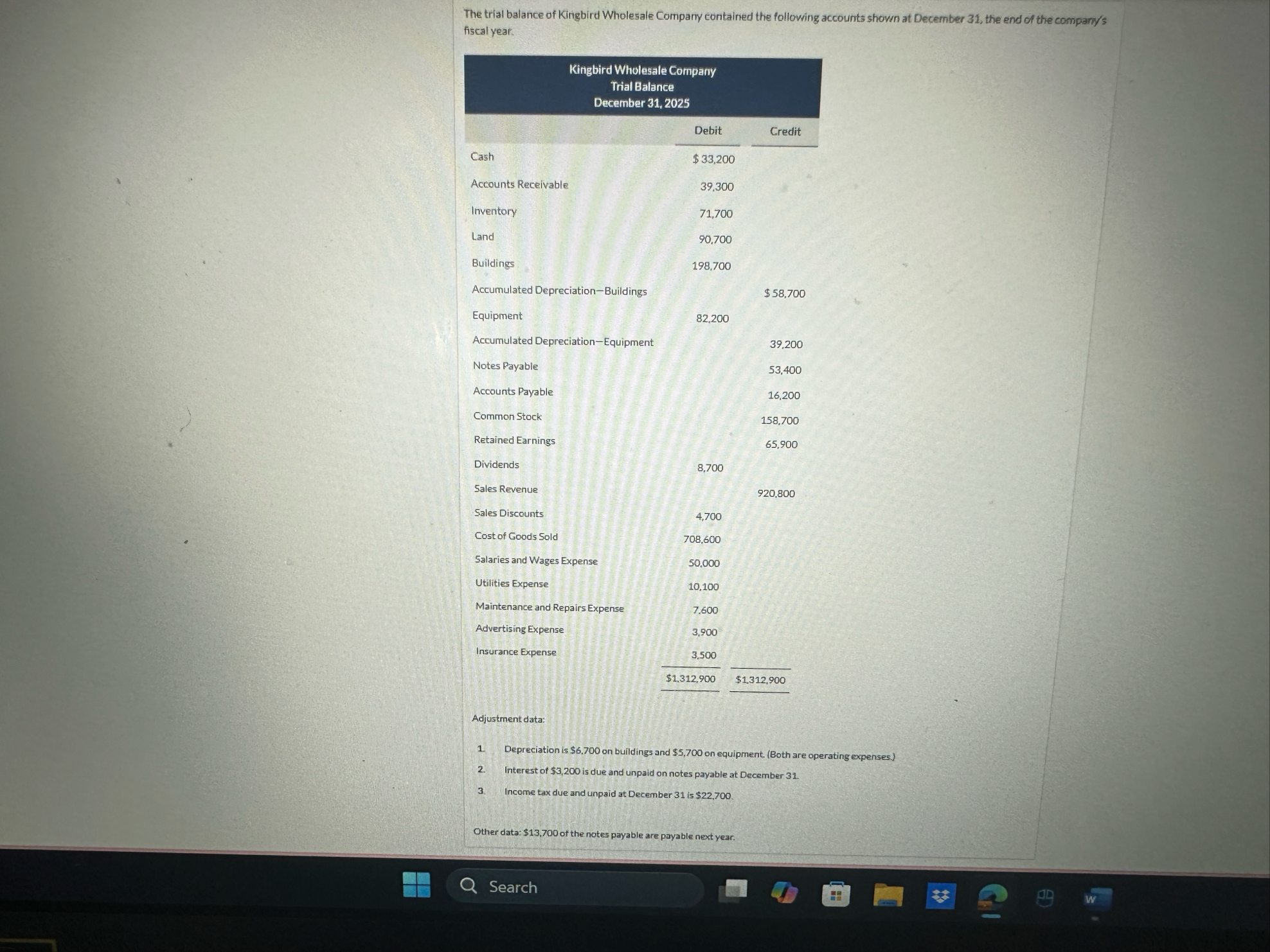

The trial balance of Kirigbird Wholesale Company contained the following accounts shown at December 31, the end of the company/s fiscal year. \table[[Kingbird Wholesale Company Trial Balance December 31, 2025],[,Debit,Credit],[Cash,$ 33,200,],[Accounts Receivable,39,300,],[Inventory,71,700,],[Land,90,700,],[Buildings,198,700,],[Accumulated Depreciation-Buildings,,$ 58,700],[Equipment,82,200,],[Accumulated Depreciation-Equipment,,39,200],[Notes Payable,,53,400],[Accounts Payable,,16,200],[Common Stock,,158,700],[Retained Earnings,,65,900],[Dividends,8,700,],[Sales Revenue,,920,800],[Sales Discounts,4,700,],[Cost of Goods Sold,708,600,],[Salaries and Wages Expense,50,000,],[Utilities Expense,10,100,],[Maintenance and Repairs Expense,7.600,],[Advertising Expense,3,900,],[Insurance Expense,3.500,],[,$1,312,900,$1,312,900]] Adjustment data: Depreciation is

$6,700on buildings and

$5,700on equipment. (Both are operating expenses.) Interest of

$3,200is due and unpaid on notes payable at December 31. Income tax due and unpaid at December 31 is

$22,700. Other data:

$13,700of the notes payable are payable next year. SearchAdjustment data: 1 Depreciation is

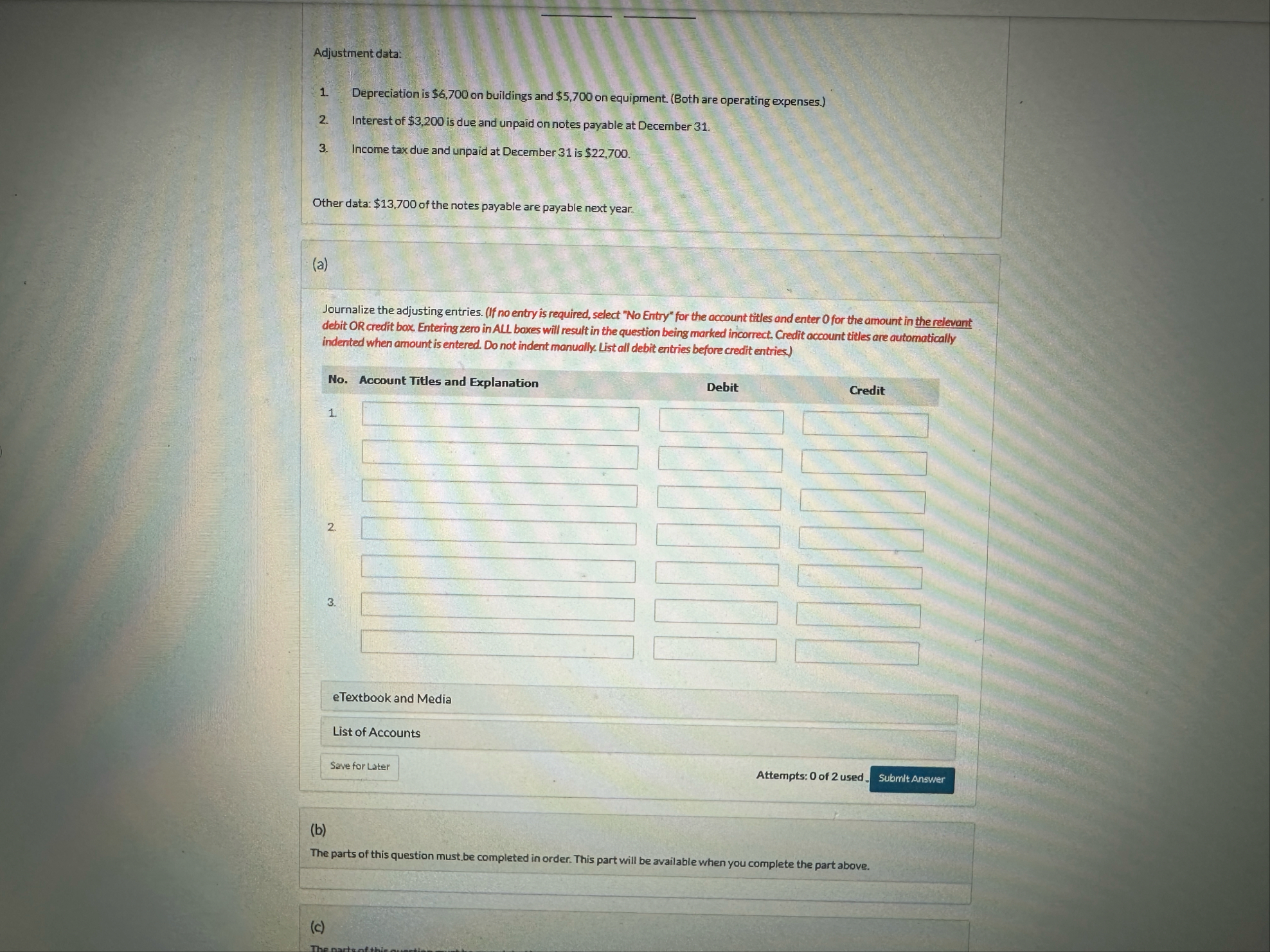

$6,700on buildings and

$5,700on equipment. (Both are operating expenses.) 2. Interest of

$3,200is due and unpaid on notes payable at December 31. 3. Income tax due and unpaid at December 31 is

$22,700. Other data:

$13,700of the notes payable are payable next year. (a) Journalize the adjusting entries. (If no entry is required, select "No Entry" for the account titles and enter O for the amount in the relevant debit OR credit box Entering zero in ALL boxes will result in the question being marked incorrect. Credit account titles are automatically indented when amount is entered. Do not indent manually List all debit entries before credit entries) No. Account Titles and Explanation

?

?Debit Credit

?

?

?

?

?

?

?

?

?

?

?

?

?

?

?

?

?

?eTextbook and Media List of Accounts

q,Attempts: 0 of 2 used.

q,(b) The parts of this question must be completed in order. This part will be available when you complete the part above. (c)