Home /

Expert Answers /

Accounting /

which-of-the-following-acts-if-any-constitute-grounds-for-a-tax-preparer-penalty-at-the-taxpa-pa420

(Solved): Which of the following acts, if any, constitute grounds for a tax preparer penalty? At the taxpa ...

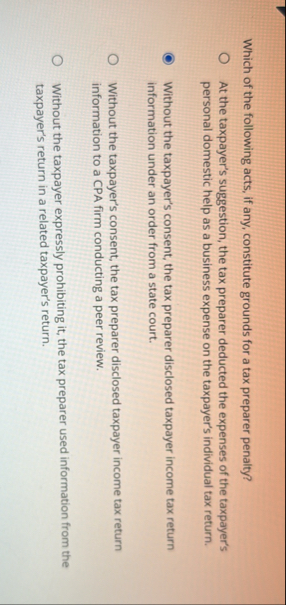

Which of the following acts, if any, constitute grounds for a tax preparer penalty?

?At the taxpayer's suggestion, the tax preparer deducted the expenses of the taxpayer's personal domestic help as a business expense on the taxpayer's individual tax return.

?Without the taxpayer's consent, the tax preparer disclosed taxpayer income tax return information under an order from a state court.

?Without the taxpayer's consent, the tax preparer disclosed taxpayer income tax return information to a CPA firm conducting a peer review.

?Without the taxpayer expressly prohibiting it, the tax preparer used information from the taxpayer's return in a related taxpayer's return.