Home /

Expert Answers /

Economics /

1-two-equipments-are-being-considered-for-an-excavation-job-alternative-i-initial-cost-of-equipm-pa377

(Solved): [1] Two equipments are being considered for an excavation job: Alternative I: Initial cost of equipm ...

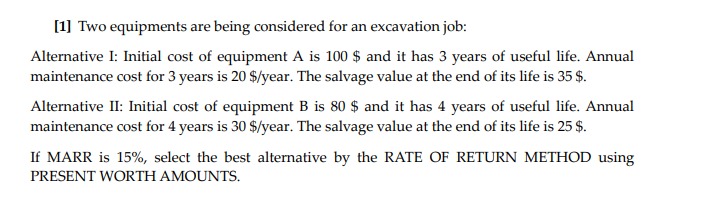

[1] Two equipments are being considered for an excavation job: Alternative I: Initial cost of equipment A is 100 \$ and it has 3 years of useful life. Annual maintenance cost for 3 years is 20 \$/year. The salvage value at the end of its life is 35 \$. Alternative II: Initial cost of equipment B is 80 \$ and it has 4 years of useful life. Annual maintenance cost for 4 years is 30 \$/year. The salvage value at the end of its life is 25 \$. If MARR is \( 15 \% \), select the best alternative by the RATE OF RETURN METHOD using PRESENT WORTH AMOUNTS.