(Solved): 1. Your company has decided to implement a Rucker plan. The information regarding base year (2021) ...

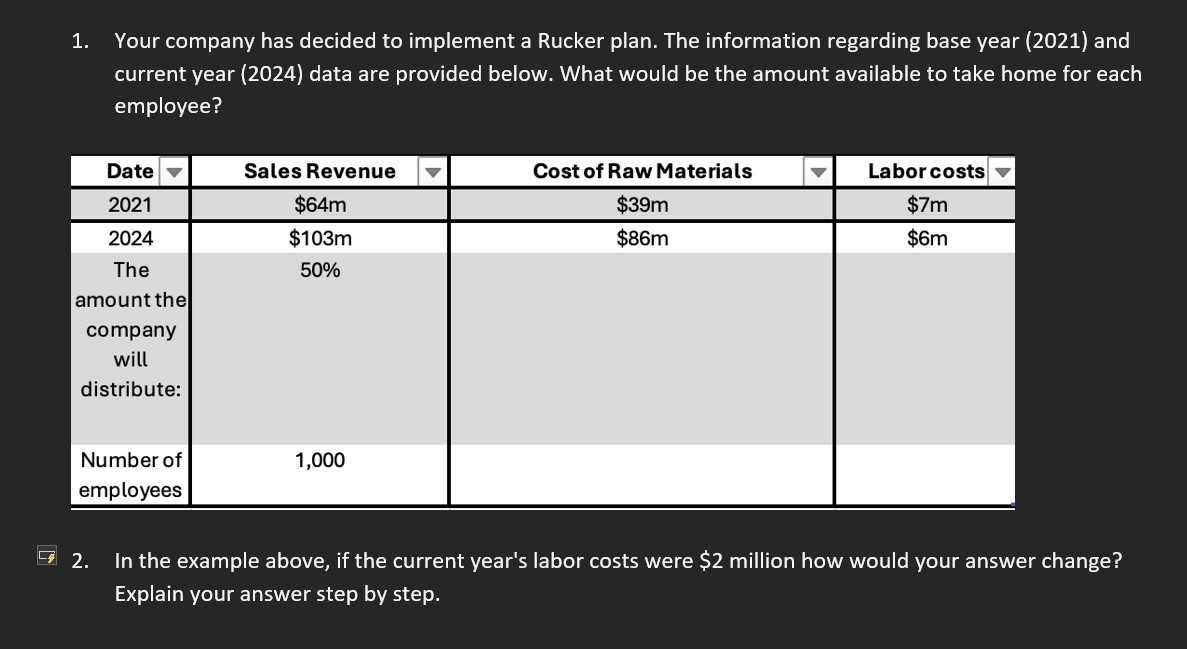

1. Your company has decided to implement a Rucker plan. The information regarding base year (2021) and current year (2024) data are provided below. What would be the amount available to take home for each employee? \begin{tabular}{|c|c|c|c|c|} \hline Date & Sales Revenue & \( \nabla \) & Cost of Raw Materials & \( \nabla \) \\ \hline 2021 & \( \$ 64 \mathrm{~m} \) & \( \$ 39 \mathrm{~m} \) & Labor costs \( \nabla \) \\ \hline 2024 & \( \$ 103 \mathrm{~m} \) & \( \$ 86 \mathrm{~m} \) & \( \$ 7 \mathrm{~m} \) \\ \hline \begin{tabular}{c} The \\ amount the \\ company \\ will \end{tabular} & \( 50 \% \) & & \( \$ 6 \mathrm{~m} \) \\ \begin{tabular}{c} distribute: \end{tabular} & & & \\ \begin{tabular}{c} Number of \\ employees \end{tabular} & 1,000 & & \\ \hline \end{tabular} 2. In the example above, if the current year's labor costs were \( \$ 2 \) million how would your answer change? Explain your answer step by step.