(Solved): ( 3 pts) The counselor mentioned in question #2 decides that she can actually afford payments of $22 ...

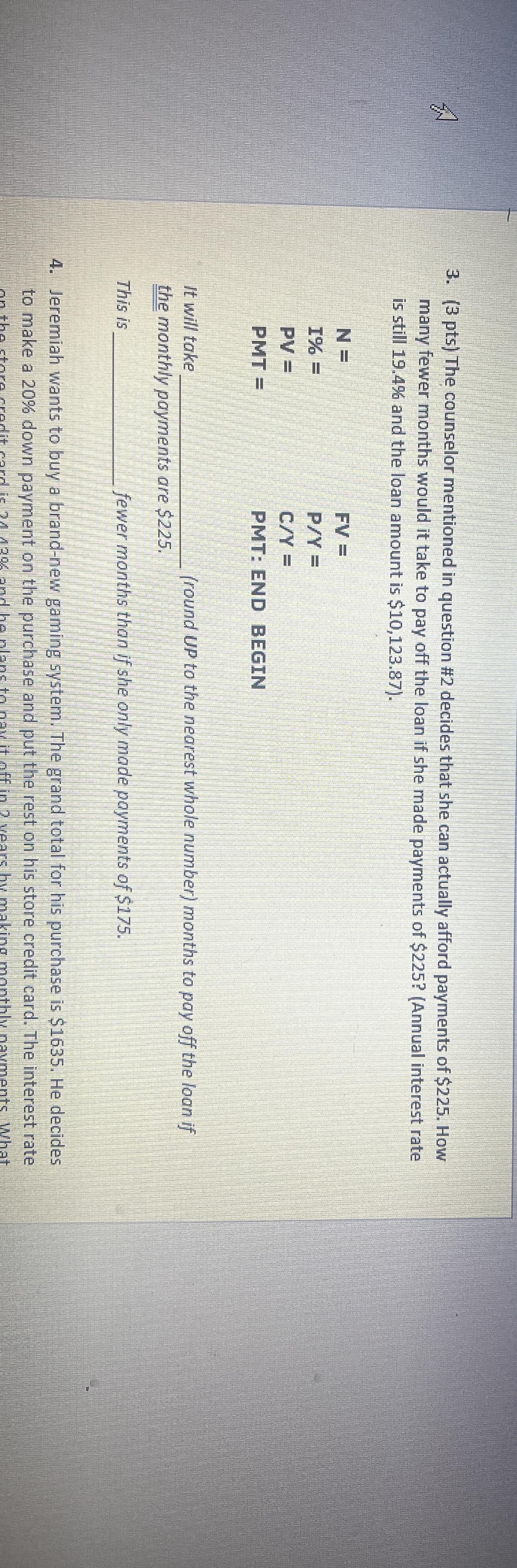

( 3 pts) The counselor mentioned in question #2 decides that she can actually afford payments of

$225. How many fewer months would it take to pay off the loan if she made payments of

$225? (Annual interest rate is still

19.4%and the loan amount is

$10,123.87).

N=

FV=

I%=

(P)/(Y)=PV

=

(C)/(Y)=PMT

=PMT: END BEGIN It will take

?(round UP to the nearest whole number) months to pay off the loan if the monthly payments are $225. This i:

?fewer months than if she only made payments of $175. 4. Jeremiah wants to buy a brand-new gaming system. The grand total for his purchase is

$1635. He decides to make a

20%down payment on the purchase and put the rest on his store credit card. The interest rate