(Solved): 5. The Directors of Hassen LLC are currently considering two mutually exclusive investment projects. ...

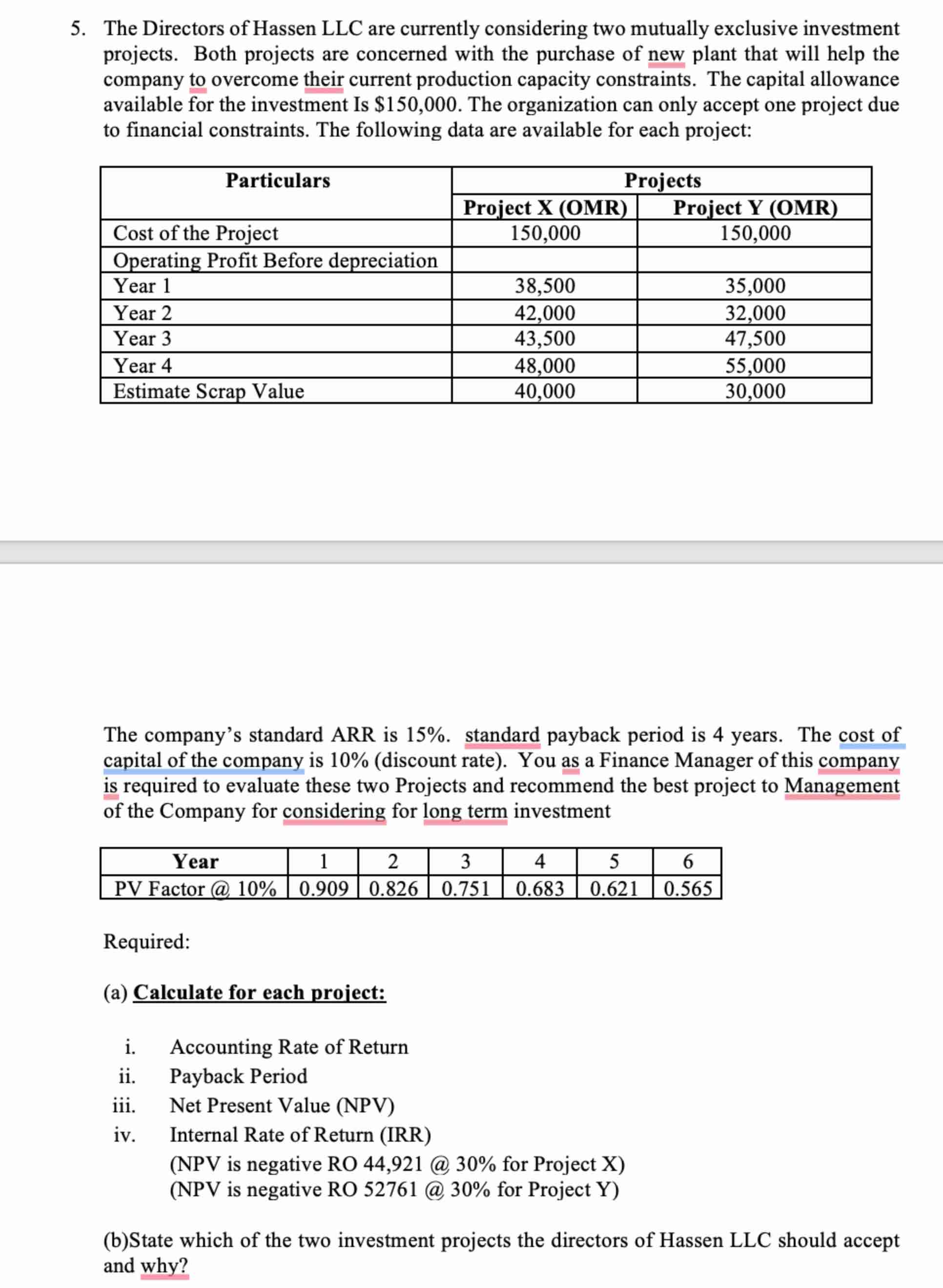

5. The Directors of Hassen LLC are currently considering two mutually exclusive investment projects. Both projects are concerned with the purchase of new plant that will help the company to overcome their current production capacity constraints. The capital allowance available for the investment Is \( \$ 150,000 \). The organization can only accept one project due to financial constraints. The following data are available for each project: The company's standard ARR is \( 15 \% \). standard payback period is 4 years. The cost of capital of the company is \( 10 \% \) (discount rate). You as a Finance Manager of this company is required to evaluate these two Projects and recommend the best project to Management of the Company for considering for long term investment Required: (a) Calculate for each project: i. Accounting Rate of Return ii. Payback Period iii. Net Present Value (NPV) iv. Internal Rate of Return (IRR) (NPV is negative RO 44,921 @ \( 30 \% \) for Project X) (NPV is negative RO 52761 @ 30\% for Project Y) (b)State which of the two investment projects the directors of Hassen LLC should accept and why?