(Solved): (7) Decedent and Spouse each own 10 percent of the voting power of Corporation A. Decedent transfers ...

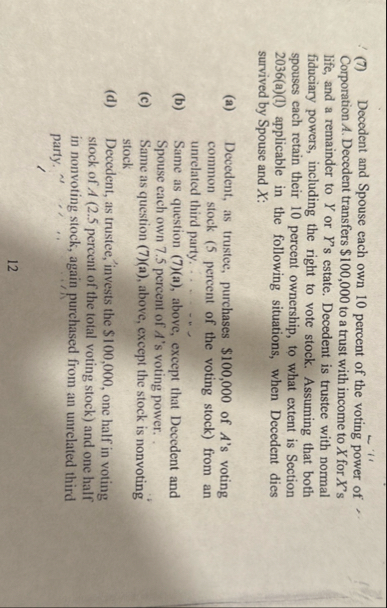

(7) Decedent and Spouse each own 10 percent of the voting power of Corporation

A. Decedent transfers

$100,000to a trust with income to

xfor

x's life, and a remainder to

Yor

Y's estate. Decedent is trustee with normal fiduciary powers, including the right to vote stock. Assuming that both spouses each retain their 10 percent ownership, to what extent is Section 2036(a)(1) applicable in the following situations, when Decedent dies survived by Spouse and

x: (a) Decedent, as trustec, purchases

$100,000of

A's voting common stock ( 5 percent of the voting stock) from an unrelated third party. (b) Same as question (7)(a), above, except that Decedent and Spouse each own 7.5 percent of

A's voting power. (c) Same as question (7)(a), above, except the stock is nonvoting stock (d) Decedent, as trustee, invests the

$100,000, one half in voting stock of

A( 2.5 percent of the total voting stock) and one half in nonvoting stock, again purchased from an unrelated third party. 12