Home /

Expert Answers /

Accounting /

a-comapany-uses-a-process-cost-accounting-system-its-assembly-department-39-s-beginning-inventory-co-pa786

(Solved): A comapany uses a process cost accounting system. Its Assembly Department's beginning inventory cons ...

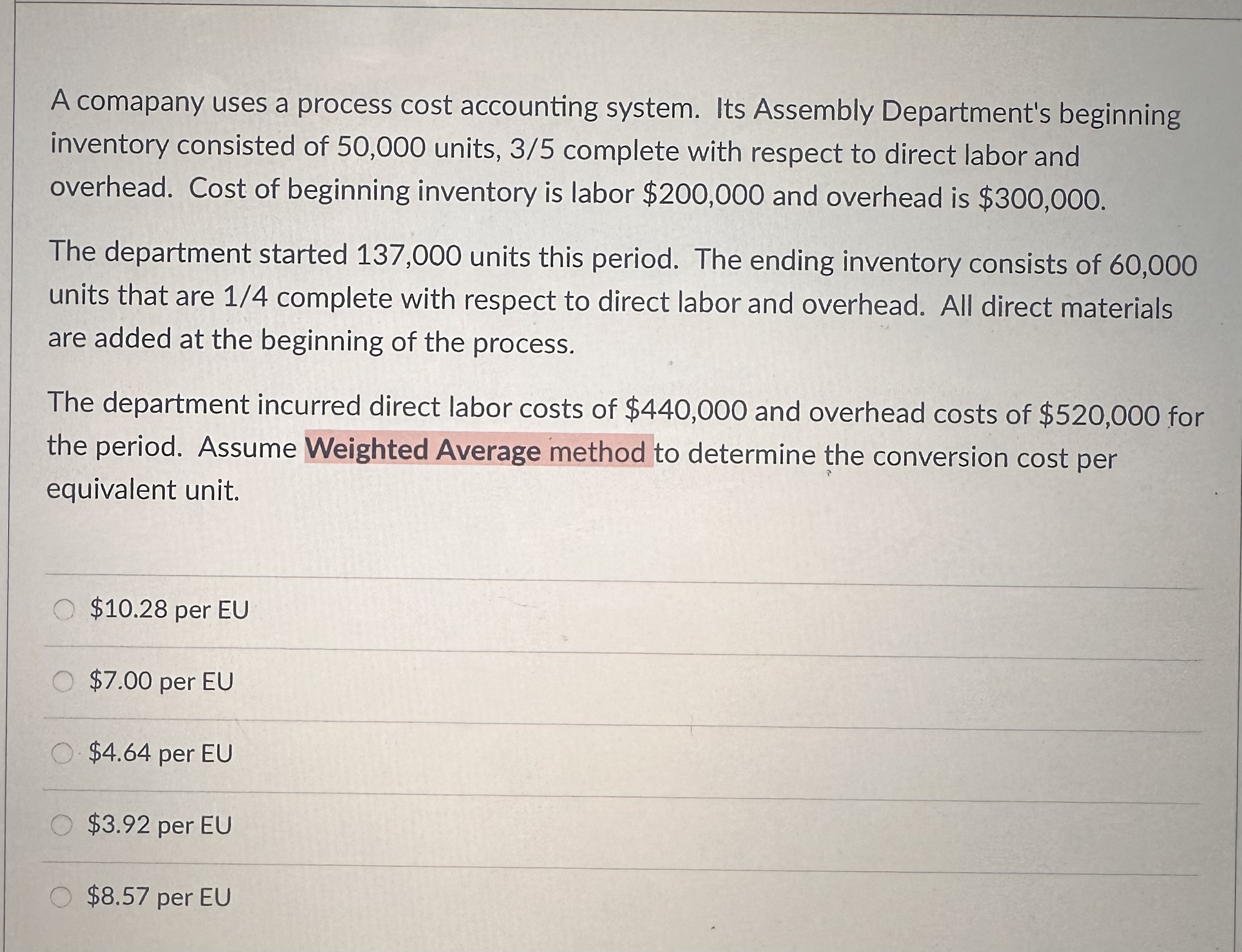

A comapany uses a process cost accounting system. Its Assembly Department's beginning inventory consisted of 50,000 units,

(3)/(5)complete with respect to direct labor and overhead. Cost of beginning inventory is labor

$200,000and overhead is

$300,000. The department started 137,000 units this period. The ending inventory consists of 60,000 units that are

(1)/(4)complete with respect to direct labor and overhead. All direct materials are added at the beginning of the process. The department incurred direct labor costs of

$440,000and overhead costs of

$520,000for the period. Assume Weighted Average method to determine the conversion cost per equivalent unit.

$10.28per EU

$7.00per EU

$4.64per EU

$3.92per EU

$8.57per EU