Home /

Expert Answers /

Finance /

a-diagram-of-the-cml-and-sml-for-the-market-m-riskfree-asset-r-f-an-inefficient-portfolio-p-an-pa324

(Solved): A diagram of the CML and SML for the market M, riskfree asset r_(f), an inefficient portfolio. P, an ...

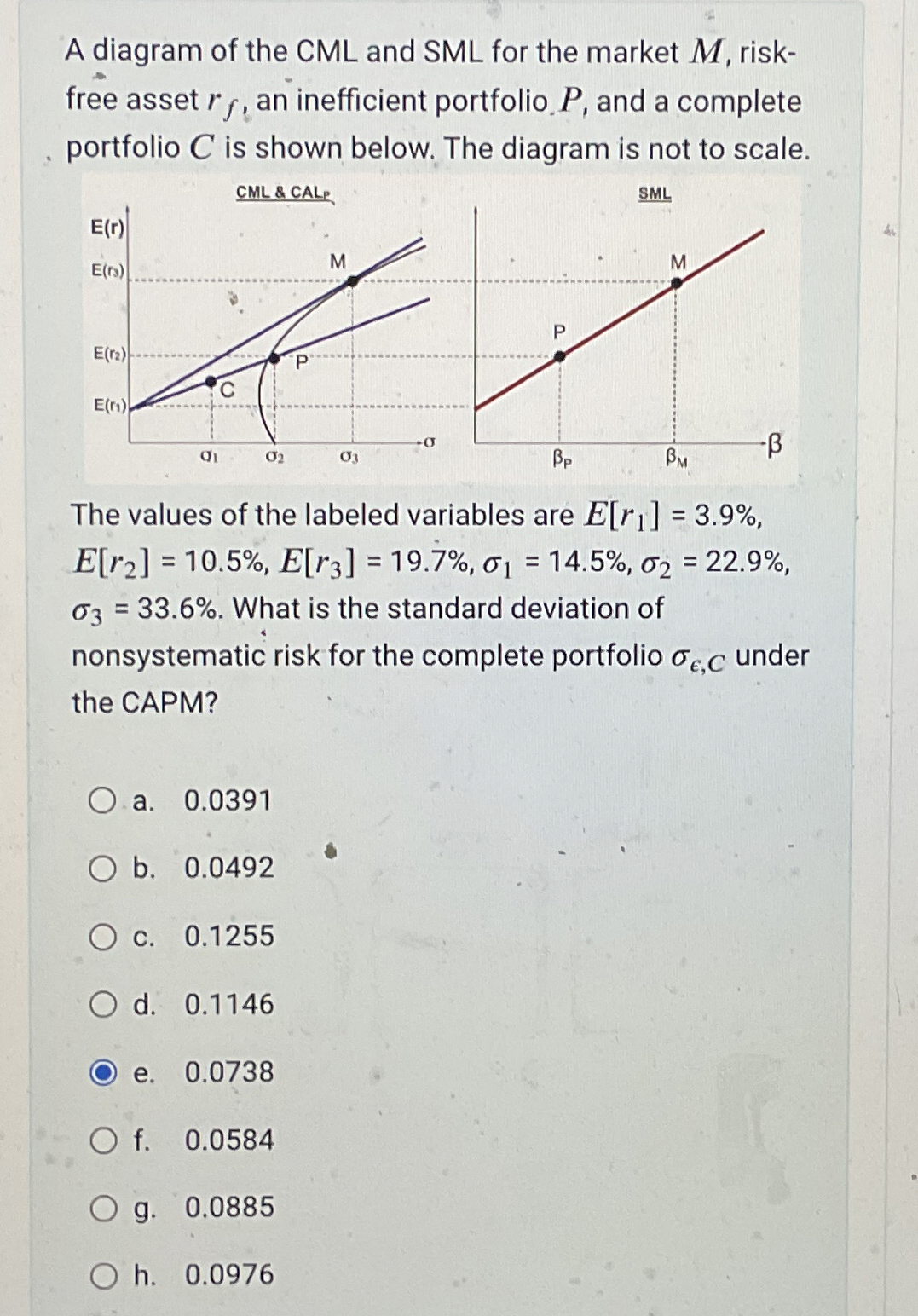

A diagram of the CML and SML for the market

M, riskfree asset

r_(f), an inefficient portfolio.

P, and a complete portfolio

Cis shown below. The diagram is not to scale. The values of the labeled variables are

E[r_(1)]=3.9%,

E[r_(2)]=10.5%,E[r_(3)]=19.7%,\sigma _(1)=14.5%,\sigma _(2)=22.9%,

\sigma _(3)=33.6%. What is the standard deviation of nonsystematic risk for the complete portfolio

\sigma _(\epsi lon,C)under the CAPM? a. 0.0391 b. 0.0492 c. 0.1255 d. 0.1146 e. 0.0738 f. 0.0584 g. 0.0885 h. 0.0976