(Solved): Accounting for Fair Value Hedge: Interest Rate Swap On January 1 of Year 1, Innovative Lab issued a ...

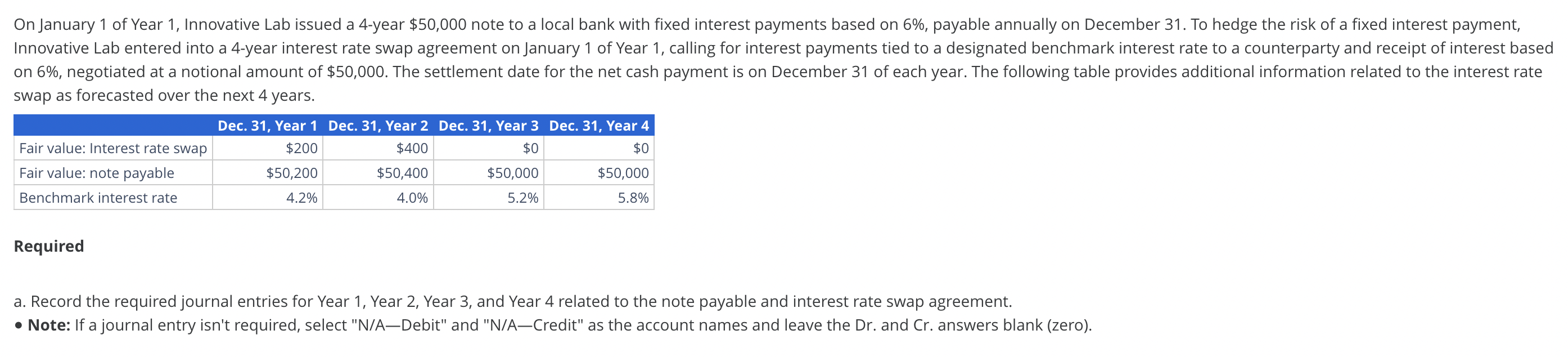

Accounting for Fair Value Hedge: Interest Rate Swap On January 1 of Year 1, Innovative Lab issued a 4 -year

$50,000note to a local bank with fixed interest payments based on

6%, payable annually on December 31 . To hedge the risk of a fixed interest payment, on

6%, negotiated at a notional amount of

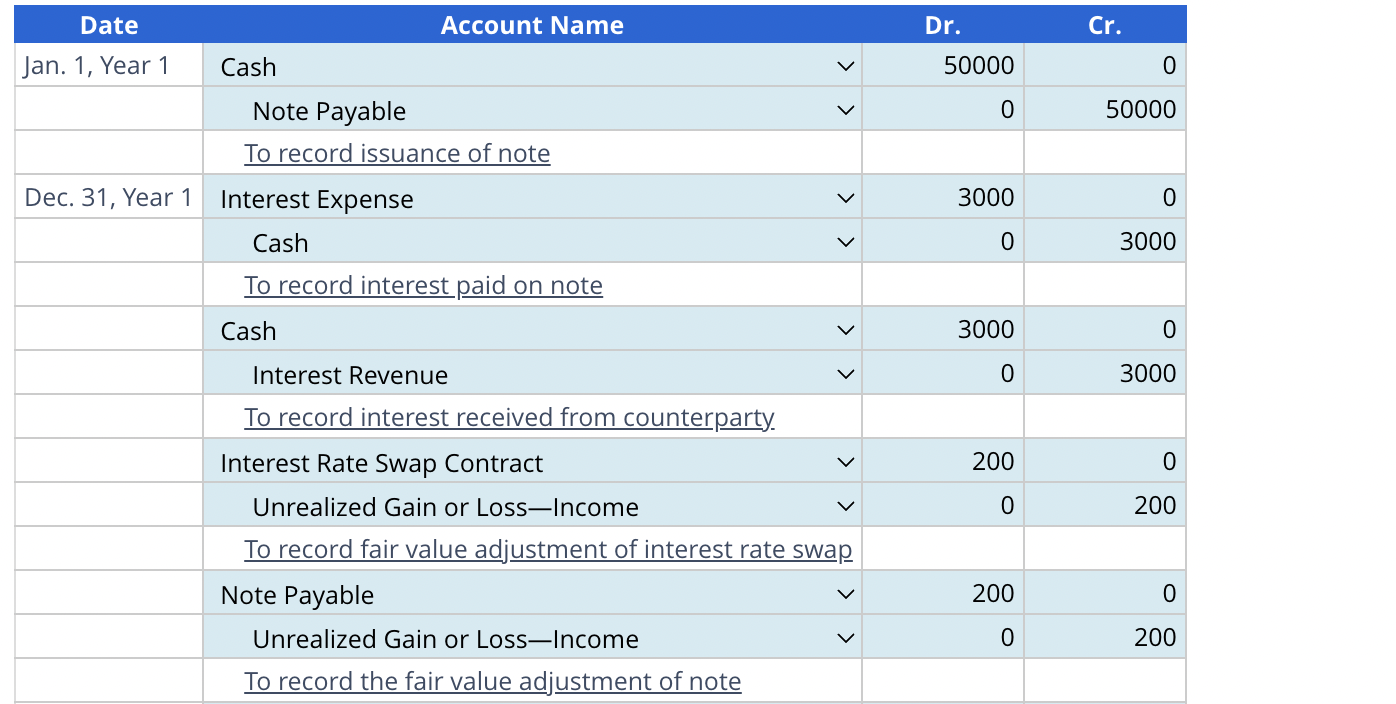

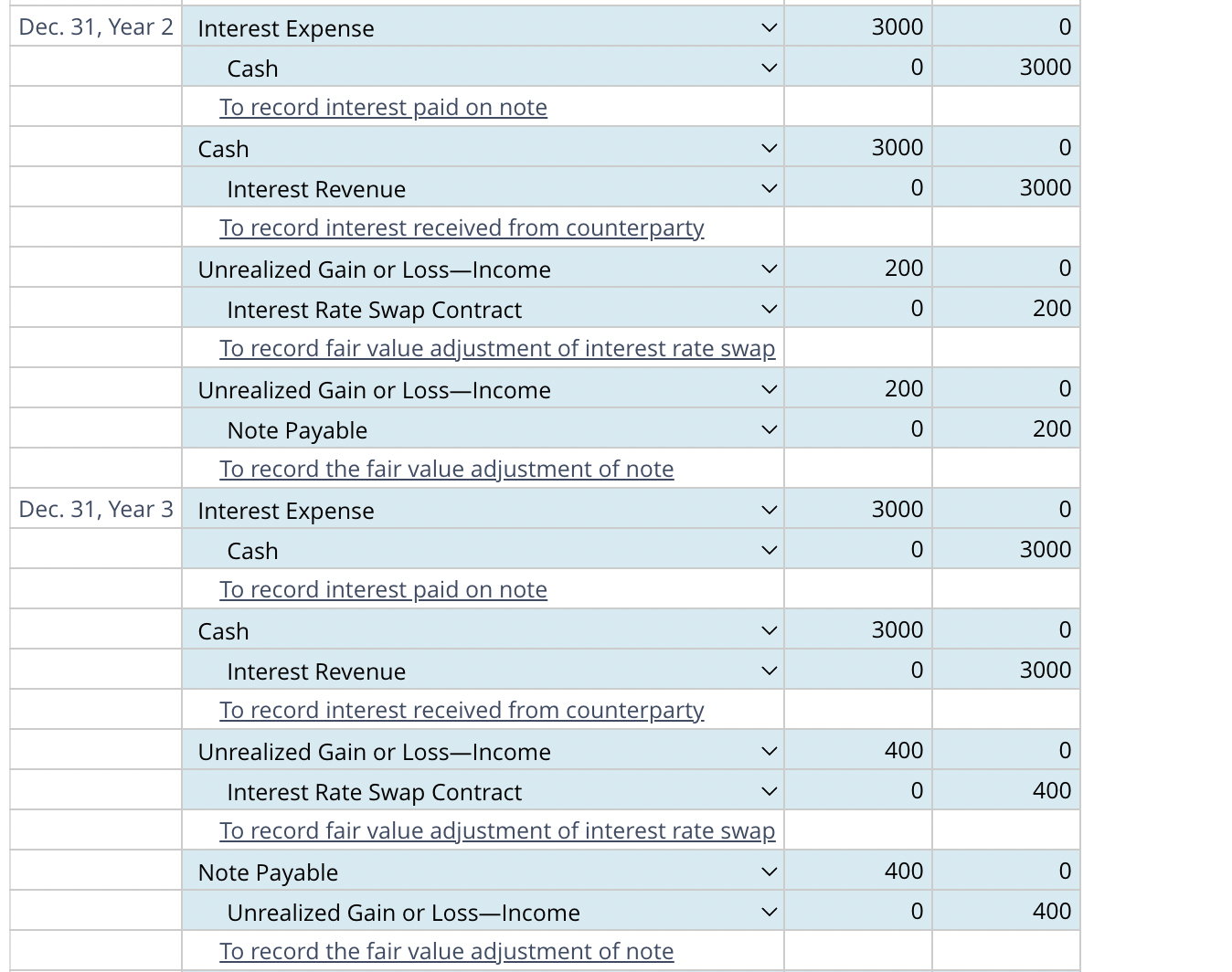

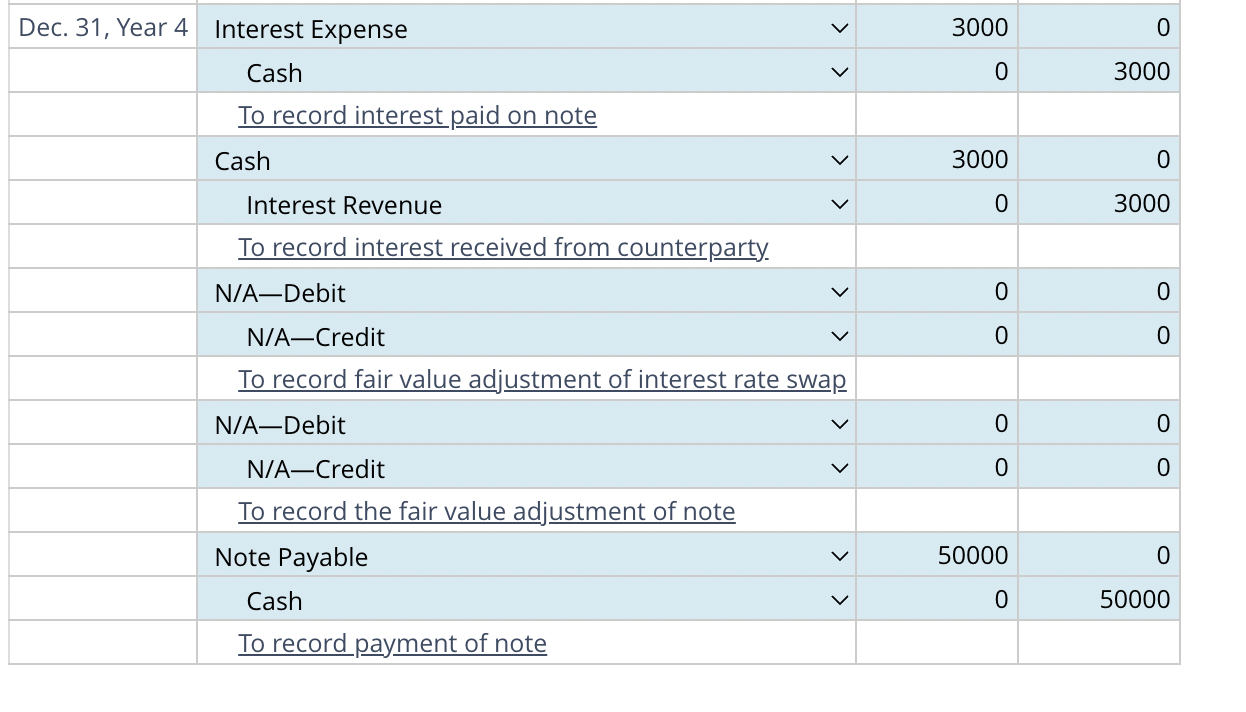

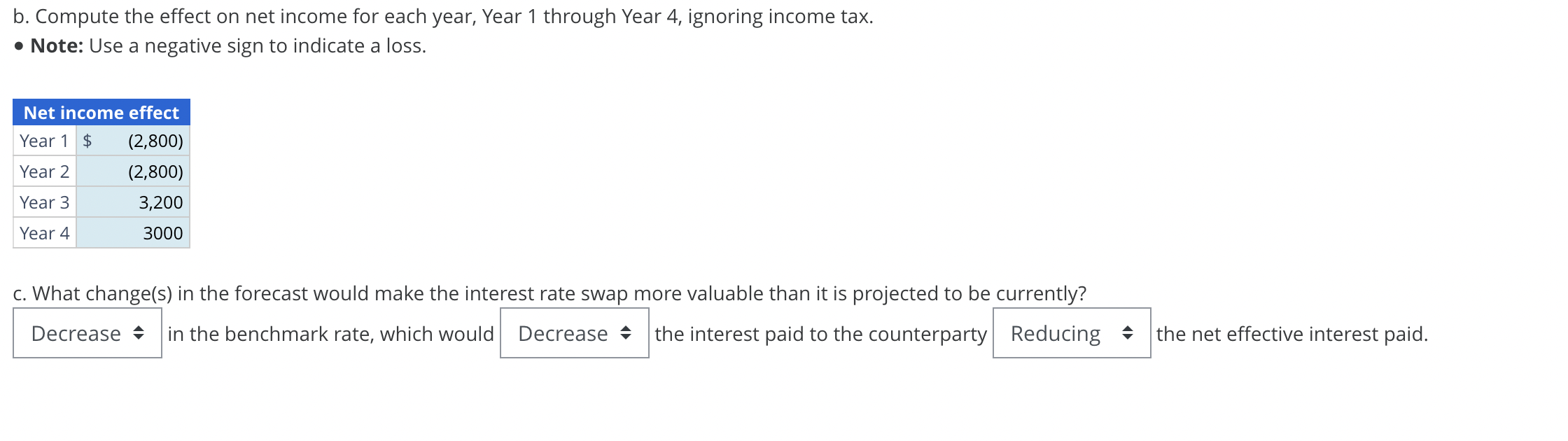

$50,000. The settlement date for the net cash payment is on December 31 of each year. The following table provides additional information related to the interest rate swap as forecasted over the next 4 years. \table[[,Dec. 31, Year 1,Dec. 31, Year 2,Dec. 31, Year 3,Dec. 31, Year 4],[Fair value: Interest rate swap,$200,$400,$0,$0],[Fair value: note payable,$50,200,$50,400,$50,000,$50,000],[Benchmark interest rate,4.2%,4.0%,5.2%,5.8%]] Required a. Record the required journal entries for Year 1, Year 2, Year 3, and Year 4 related to the note payable and interest rate swap agreement. Note: If a journal entry isn't required, select "N/A—Debit" and "N/A—Credit" as the account names and leave the Dr. and Cr. answers blank (zero). \table[[Date,Account Name,Dr.,Cr.],[Jan. 1, Year 1,Cash,50000,0],[Note Payable,0,50000],[To record issuance of note,,],[Dec. 31, Year 1,Interest Expense,3000,0],[Cash,0,3000],[To record interest paid on note,,],[Cash,3000,0],[Interest Revenue,0,3000],[To record interest received from counterparty.,,],[Interest Rate Swap Contract,200,0],[Unrealized Gain or Loss—Income,0,200],[To record fair value adjustment of interest rate swap,,],[Note Payable,200,0],[Unrealized Gain or Loss-Income,0,200],[To record the fair value adjustment of note,,]] \table[[Dec. 31, Year 4,Interest Expense,v,3000,0],[Cash,v,0,3000],[To record interest,,,],[Cash,v,3000,0],[Interest Revenue,v,0,3000],[To record interest,F,,],[N/A—Debit,v,0,0],[N/A—Credit,v,0,0],[To record fair valu,,,],[N/A—Debit,v,0,0],[N/A-Credit,v,0,0],[To record the fair,,,],[Note Payable,v,50000,0],[Cash,v,0,50000],[To reco,,,]]b. Compute the effect on net income for each year, Year 1 through Year 4, ignoring income tax. Note: Use a negative sign to indicate a loss. c. What change(s) in the forecast would make the interest rate swap more valuable than it is projected to be currently? Decrease

?^(?)in the benchmark rate, which would the interest paid to the counterparty the net effective interest paid. On January 1 of Year 1, Innovative Lab issued a 4-year $50,000 note to a local bank with ?xed interest payments based on 6%, payable annually on December 31. To hedge the risk of a ?xed interest payment, Innovative Lab entered into a 4-year interest rate swap agreement on January 1 of Year 1, calling for interest payments tied to a designated benchmark interest rate to a counterparty and receipt of interest based on 6%, negotiated at a notional amount of $50,000. The settlement date for the net cash payment is on December 31 of each year. The following table provides additional information related to the interest rate swap as forecasted over the next 4 years. Dec. 31, Year 1 Dec. 31, Year 2 Dec. 31, Year 3 Dec. 31, Year 4 Fair value: Interest rate swap $200 $400 $0 $0 Fair value: note payable $50,200 $50,400 $50,000 $50,000 Benchmark interest rate 4.2% 4.0% 5.2% 5.8% Required a. Record the required journal entries for Year 1, Year 2, Year 3, and Year 4 related to the note payable and interest rate swap agreement. ? Note: If a journal entry isn't required, select "N/A—Debit" and "N/A—Credit" as the account names and leave the Dr. and Cr. answers blank (zero).