(Solved): After Grandma Ruth's death in 2024, Grandpa Jim now owns the full value of a campground with a fair ...

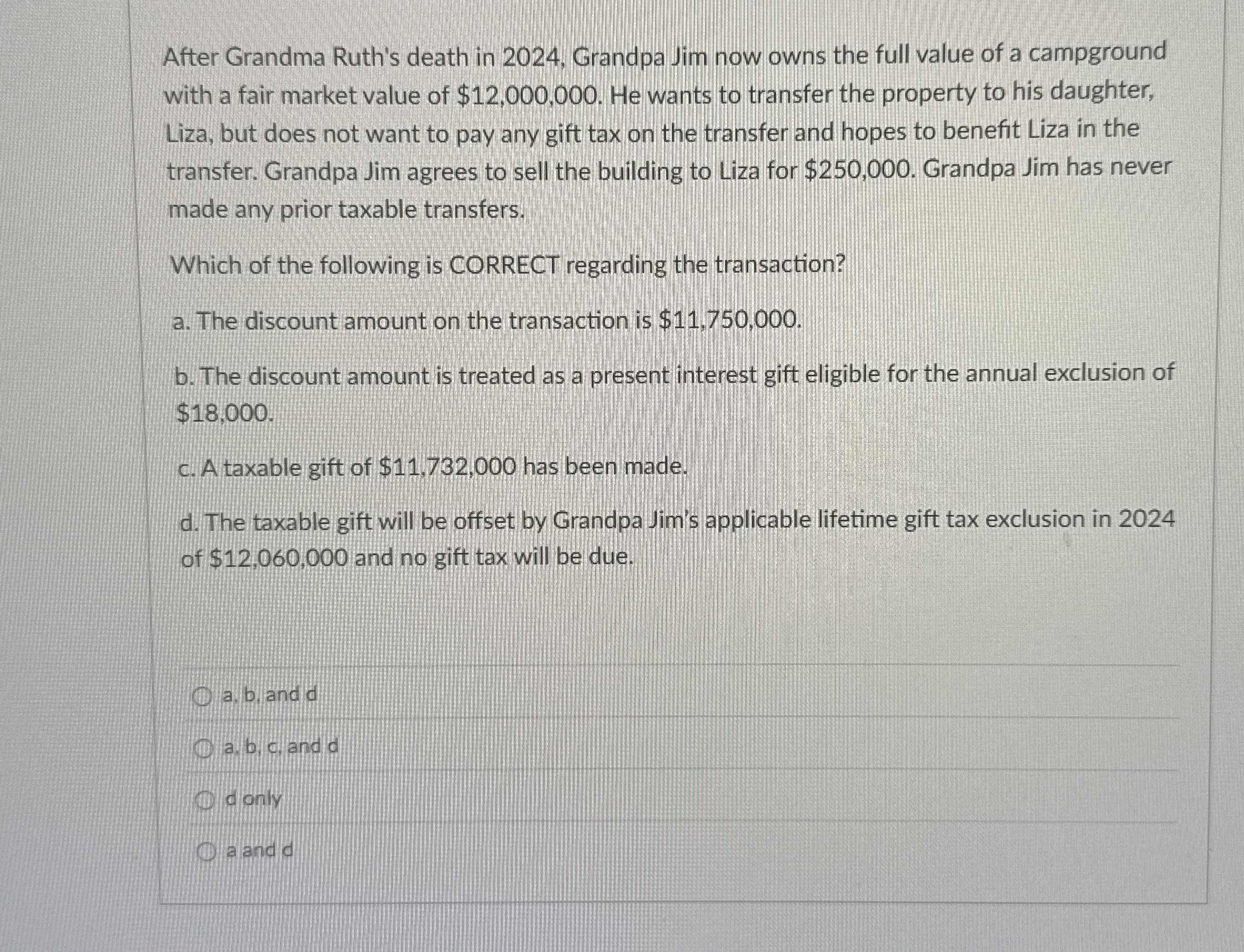

After Grandma Ruth's death in 2024, Grandpa Jim now owns the full value of a campground with a fair market value of

$12,000,000. He wants to transfer the property to his daughter, Liza, but does not want to pay any gift tax on the transfer and hopes to benefit Liza in the transfer. Grandpa Jim agrees to sell the building to Liza for

$250,000. Grandpa Jim has never made any prior taxable transfers. Which of the following is CORRECT regarding the transaction? a. The discount amount on the transaction is

$11,750,000. b. The discount amount is treated as a present interest gift eligible for the annual exclusion of $18,000. c. A taxable gift of

$11,732,000has been made. d. The taxable gift will be offset by Grandpa Jim's applicable lifetime gift tax exclusion in 2024 of

$12,060,000and no gift tax will be due. a, b, and d a. b. c. and d donly a and d