Home /

Expert Answers /

Finance /

allied-biscuit-co-has-to-choose-between-two-mutually-exclusive-projects-if-it-chooses-project-a-pa556

(Solved): Allied Biscuit Co, has to choose between two mutually exclusive projects. If it chooses project A, ...

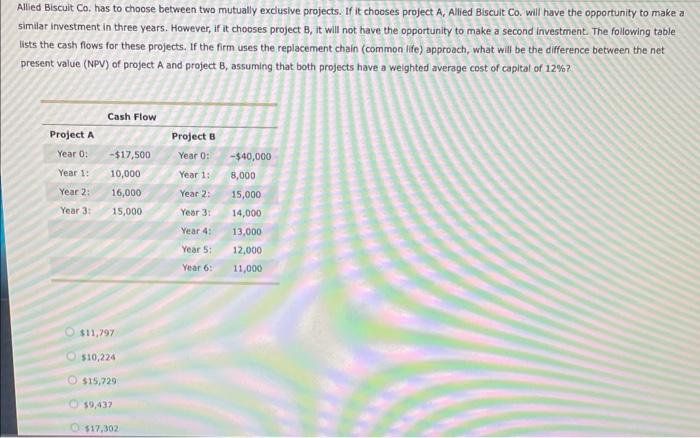

Allied Biscuit Co, has to choose between two mutually exclusive projects. If it chooses project A, Allied Biscult Co. will have the opportunity to make a similar investment in three years. However, if it chooses project B, it will not have the opportunity to make a second investment The following table lists the cash flows for these projects. If the firm uses the replacement chain (common life) approach, what will be the difference between the net present value (NPV) of project A and project B, assuming that both projects have a weighted average cost of capital of \( 12 \% \) ? \( \$ 11,797 \) 510,224 \( \$ 15,729 \) 39,437 \( \$ 17,302 \)

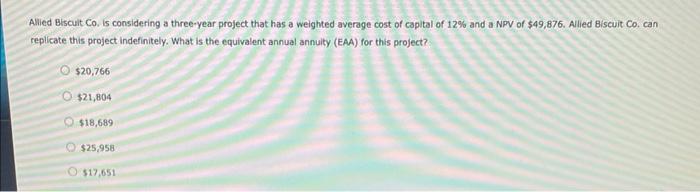

Allied Biscuit Co. Is considering a three-year project that has a weighted average cost of capital of \( 12 \% \) and a \( \mathrm{NPV} \) of \( \$ 49,876 \). Allied 8 iscuit Co. can replicate this project indefinitely. What is the equivalent annual annulty (EAA) for this project? \[ \$ 20,766 \] \[ \begin{array}{l} \$ 21,804 \\ \$ 18,689 \end{array} \] \( \$ 25,958 \) 517,651

Expert Answer

calculation of cash flows from repeating project A: year project A repeated total 0 -17500 -17500 1 10000 10000 2 16000 16000 3 15000 -17500 -2500 4 1