(Solved): Assume that the true linear regression model is given by Y_(i)=x_(i)^(TT)\beta +\epsi _(i) where x ...

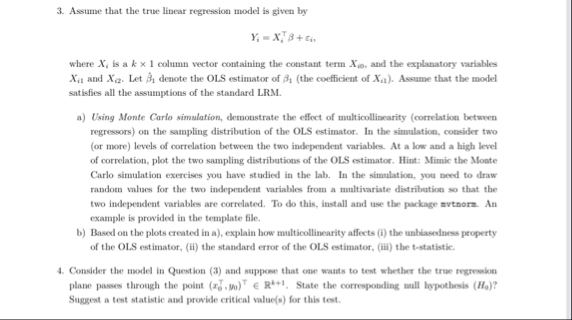

Assume that the true linear regression model is given by

Y_(i)=x_(i)^(TT)\beta +\epsi _(i)where

x_(i)is a

k\times 1column vector containing the constant term

x_(i0), and the explanatory variables

x_(i1)and

x_(i2). Let

\beta _(1)^(?)denote the OLS estimator of

\beta _(1)(the coefficient of

x_(i1)). Assume that the model satisfies all the assumptions of the standard LRM. a) Using Monte Carlo simulation, demonstrate the effect of multicollinearity (correlation between regressors) on the sampling distribution of the OLS estimator. In the simulation, consider two (or more) levels of correlation between the two independent variables. At a low and a high level of correlation, plot the two sampling distributions of the OLS estimator. Hint: Mimic the Monte Carlo simulation exercises you have studied in the lab. In the simulation, you need to draw random values for the two independent variables from a multivariate distribution so that the two independent variables are correlated. To do this, install and use the package mvtnorn. An example is provided in the template file. b) Based on the plots created in a), explain how multicollinearity affects (i) the unblasedness property of the OLS estimator, (ii) the standard error of the OLS estimator, (iii) the t-statistic. 4. Consider the model in Question (3) and suppose that one wants to test whether the true regression plane passes through the point

(x_(0)^(TT),y_(0))^(TT)inR^(i+1). State the corresponding null hypothesis

(H_(0))? Suggest a test statistic and prowide critical value(s) for this test.