Home /

Expert Answers /

Accounting /

assume-that-timberline-corporation-has-2024-taxable-income-of-240-000-for-purposes-of-computing-th-pa373

(Solved): Assume that Timberline Corporation has 2024 taxable income of $240,000 for purposes of computing th ...

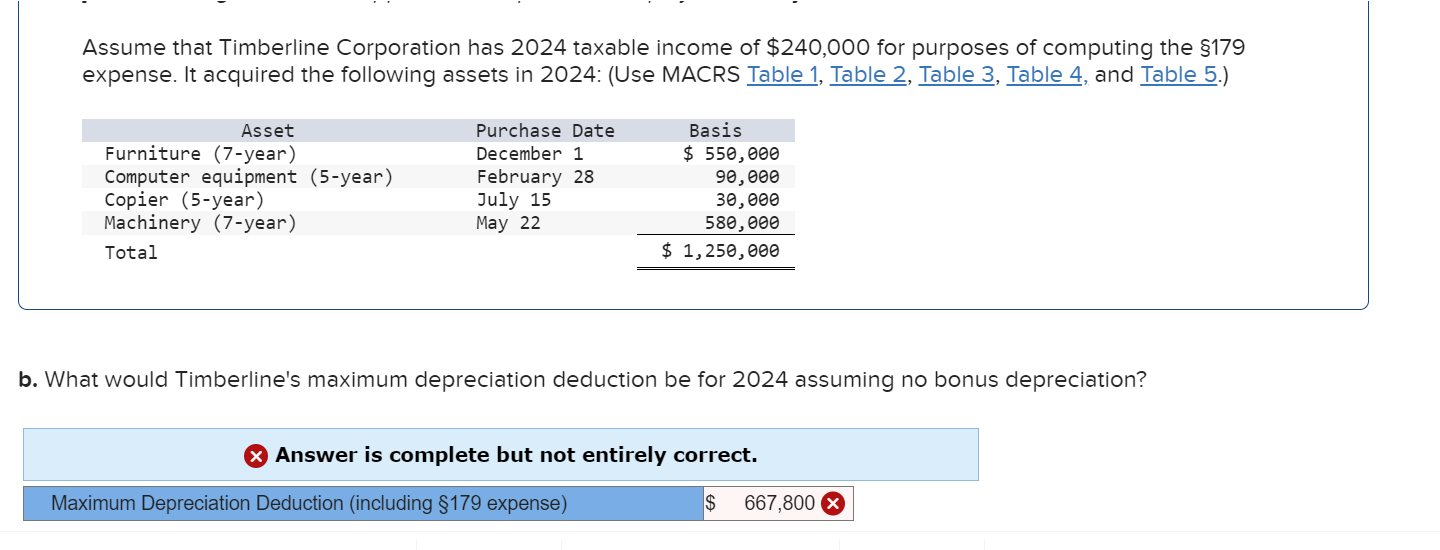

Assume that Timberline Corporation has 2024 taxable income of

$240,000for purposes of computing the

$179expense. It acquired the following assets in 2024: (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) b. What would Timberline's maximum depreciation deduction be for 2024 assuming no bonus depreciation? Answer is complete but not entirely correct.