(Solved): Babcock Company purchased a piece of machinery for \( \$ 30,000 \) on January 1,2022 , and has been ...

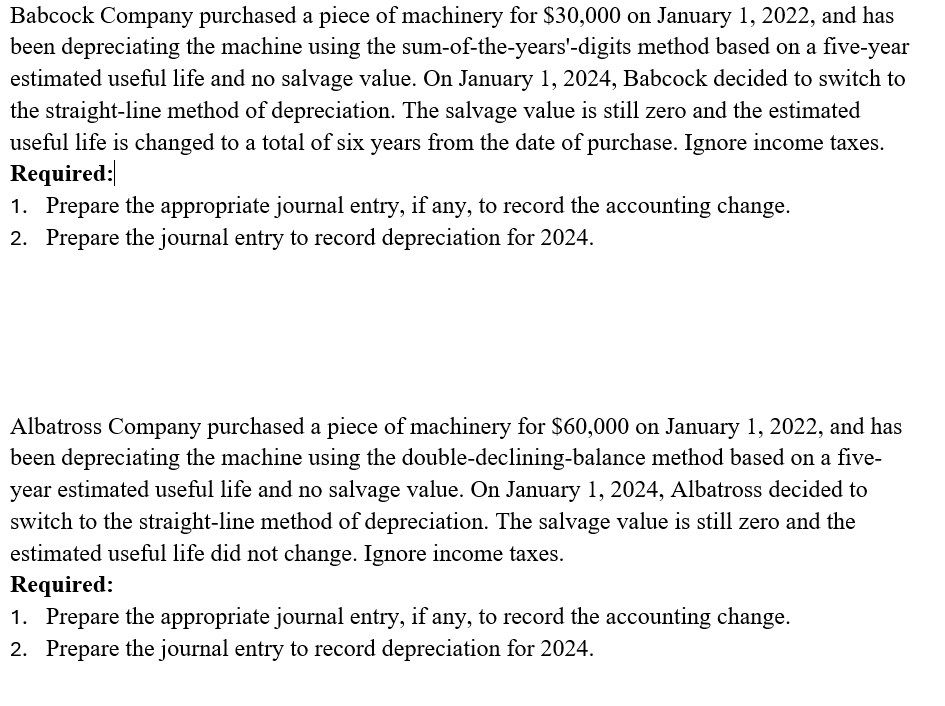

Babcock Company purchased a piece of machinery for \( \$ 30,000 \) on January 1,2022 , and has been depreciating the machine using the sum-of-the-years'-digits method based on a five-year estimated useful life and no salvage value. On January 1, 2024, Babcock decided to switch to the straight-line method of depreciation. The salvage value is still zero and the estimated useful life is changed to a total of six years from the date of purchase. Ignore income taxes. Required: 1. Prepare the appropriate journal entry, if any, to record the accounting change. 2. Prepare the journal entry to record depreciation for 2024. Albatross Company purchased a piece of machinery for \( \$ 60,000 \) on January 1, 2022, and has been depreciating the machine using the double-declining-balance method based on a fiveyear estimated useful life and no salvage value. On January 1, 2024, Albatross decided to switch to the straight-line method of depreciation. The salvage value is still zero and the estimated useful life did not change. Ignore income taxes. Required: 1. Prepare the appropriate journal entry, if any, to record the accounting change. 2. Prepare the journal entry to record depreciation for 2024.