(Solved): (Bank Reconciliation and Adjusting Entries) The cash account of Aguilar Co. showed a ledger balance ...

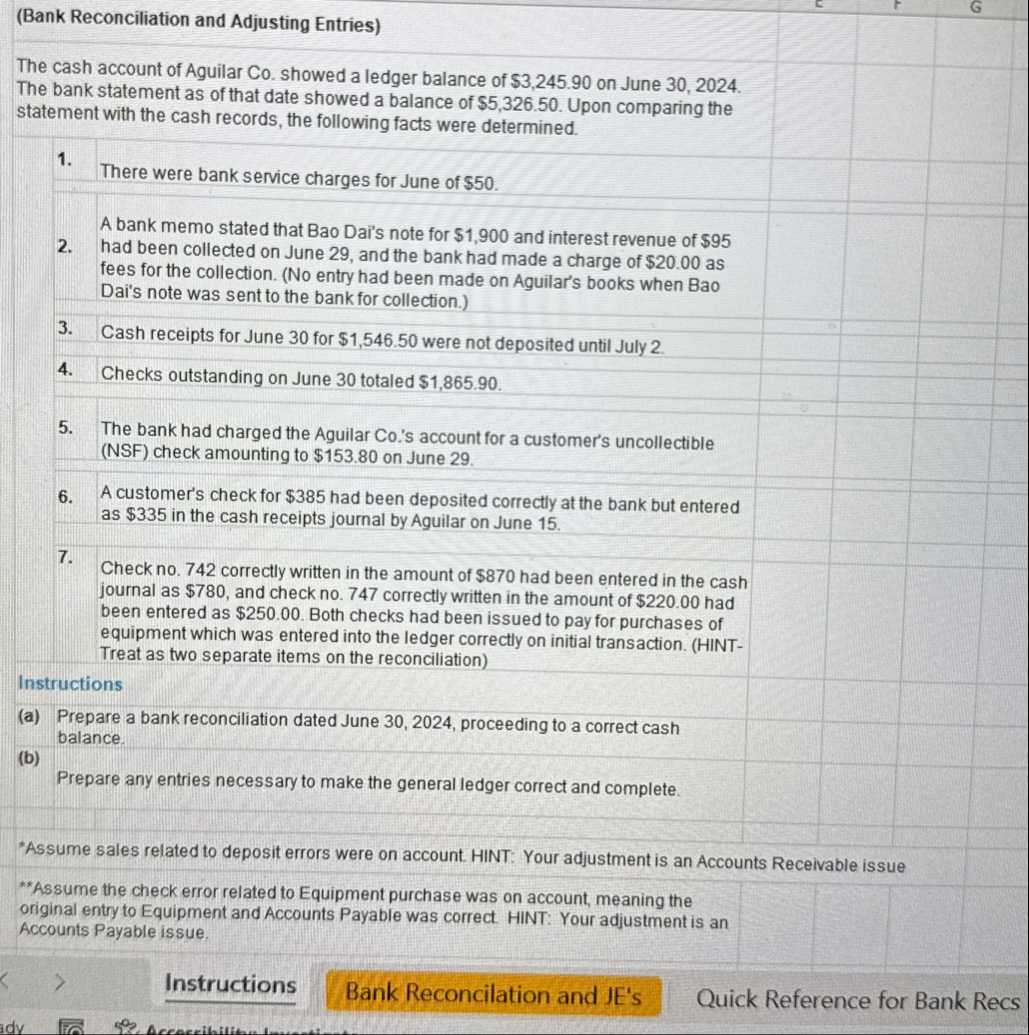

(Bank Reconciliation and Adjusting Entries) The cash account of Aguilar Co. showed a ledger balance of

$3,245.90on June 30, 2024. The bank statement as of that date showed a balance of

$5,326.50. Upon comparing the statement with the cash records, the following facts were determined. There were bank service charges for June of

$50. A bank memo stated that Bao Dai's note for

$1,900and interest revenue of

$95had been collected on June 29, and the bank had made a charge of

$20.00as fees for the collection. (No entry had been made on Aguilar's books when Bao Dai's note was sent to the bank for collection.) 3. Cash receipts for June 30 for

$1,546.50were not deposited until July 2. 4. Checks outstanding on June 30 totaled

$1,865.90. 5. The bank had charged the Aguilar Co.'s account for a customer's uncollectible (NSF) check amounting to

$153.80on June 29. 6. A customer's check for

$385had been deposited correctly at the bank but entered as

$335in the cash receipts journal by Aguilar on June 15. 7. Check no. 742 correctly written in the amount of

$870had been entered in the cash journal as

$780, and check no. 747 correctly written in the amount of

$220.00had been entered as

$250.00. Both checks had been issued to pay for purchases of equipment which was entered into the ledger correctly on initial transaction. (HINTTreat as two separate items on the reconciliation) Instructions (a) Prepare a bank reconciliation dated June 30, 2024, proceeding to a correct cash balance. (b) Prepare any entries necessary to make the general ledger correct and complete. *Assume sales related to deposit errors were on account. HINT: Your adjustment is an Accounts Receivable issue **Assume the check error related to Equipment purchase was on account, meaning the original entry to Equipment and Accounts Payable was correct. HINT: Your adjustment is an Accounts Payable issue. Instructions Bank Reconcilation and JE's Quick Reference for Bank Recs