(Solved): calculate cost of good sold using FIFO Part 5: Bank Reconciliation (15 Marks) QPS Trading Ltd. rece ...

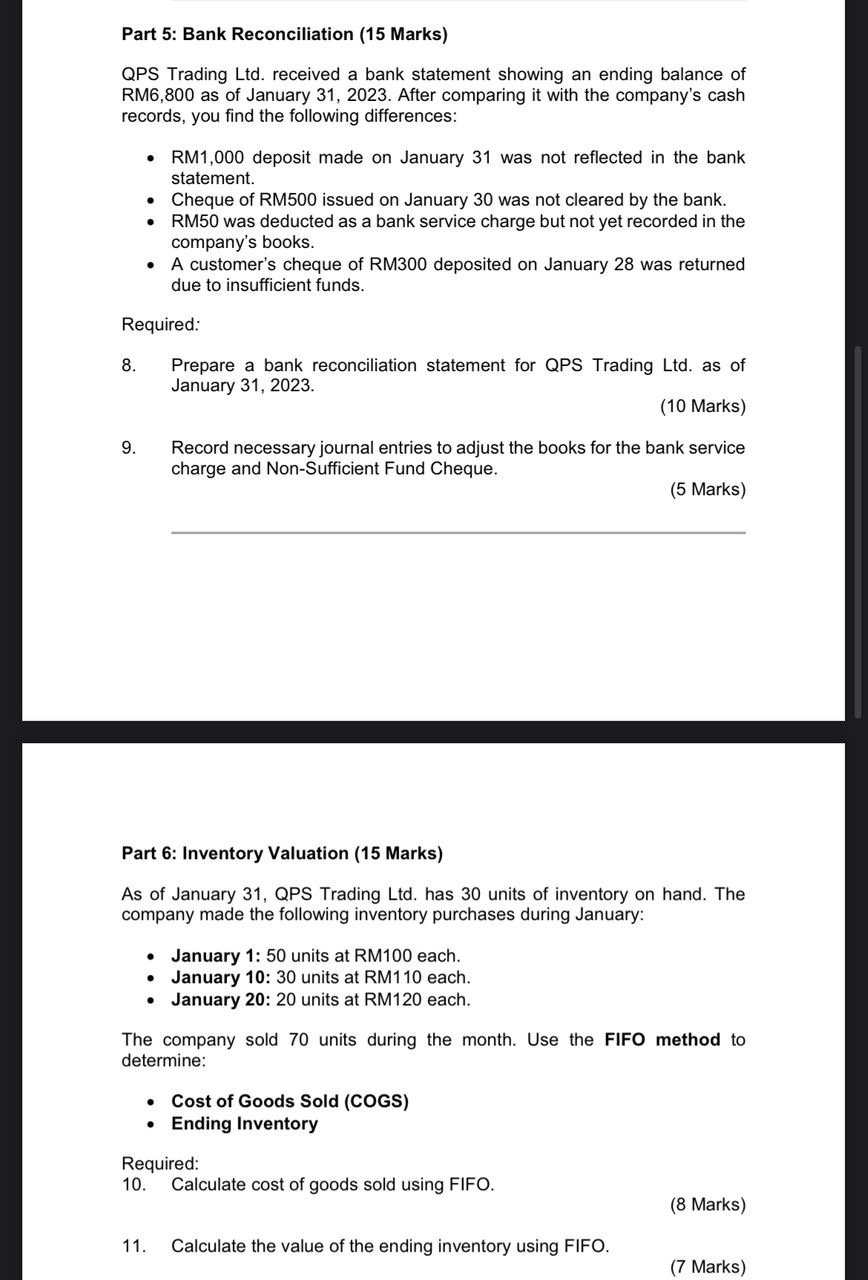

calculate cost of good sold using FIFO Part 5: Bank Reconciliation (15 Marks) QPS Trading Ltd. received a bank statement showing an ending balance of RM6,800 as of January 31, 2023. After comparing it with the company's cash records, you find the following differences: RM1,000 deposit made on January 31 was not reflected in the bank statement. Cheque of RM500 issued on January 30 was not cleared by the bank. RM50 was deducted as a bank service charge but not yet recorded in the company's books. A customer's cheque of RM300 deposited on January 28 was returned due to insufficient funds. Required: 8. Prepare a bank reconciliation statement for QPS Trading Ltd. as of January 31, 2023. (10 Marks) 9. Record necessary journal entries to adjust the books for the bank service charge and Non-Sufficient Fund Cheque. (5 Marks) Part 6: Inventory Valuation (15 Marks) As of January 31, QPS Trading Ltd. has 30 units of inventory on hand. The company made the following inventory purchases during January: January 1: 50 units at RM100 each. January 10: 30 units at RM110 each. January 20: 20 units at RM120 each. The company sold 70 units during the month. Use the FIFO method to determine: Cost of Goods Sold (COGS) Ending Inventory Required: 10. Calculate cost of goods sold using FIFO. (8 Marks) 11. Calculate the value of the ending inventory using FIFO. (7 Marks)