Home /

Expert Answers /

Accounting /

calvin-has-a-rental-house-that-was-rented-beginning-january-1-in-the-current-tax-year-on-january-1-pa909

(Solved): Calvin has a rental house that was rented beginning January 1 in the current tax year. On January 1 ...

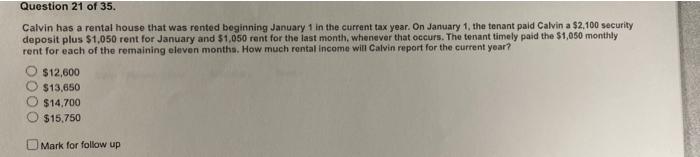

Calvin has a rental house that was rented beginning January 1 in the current tax year. On January 1 , the tenant paid Calvin a \( \$ 2.100 \) security deposit plus \( \$ 1,050 \) rent for January and \( \$ 1,050 \) rent for the last month. wheriever that occurs. The tenant timely paid the \( \$ 1,050 \) monthly rent for each of the remaining eleven monthe. How much rental income will Calvin report for the current yoar? \[ \begin{array}{|} \$ 12,600 \\ \$ 13,650 \\ \$ 14,700 \\ \$ 15,750 \end{array} \] Mark for follow up

Expert Answer

Answer: Rental income for 12 months =