(Solved): Canal Company is contemplating the purchase of a new leather sewing machine to replace the existing ...

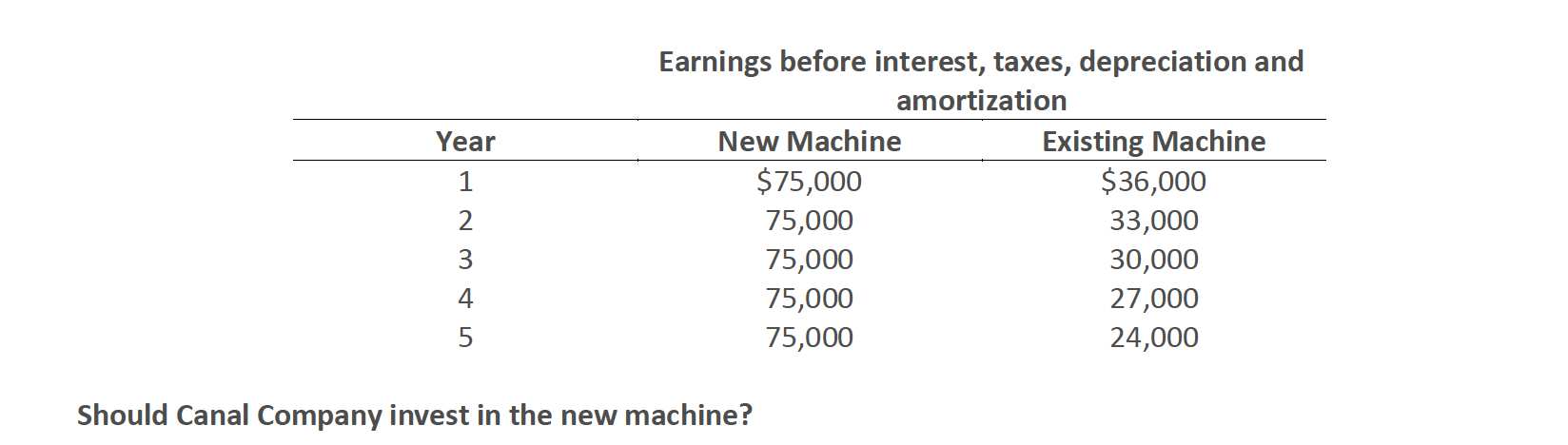

Canal Company is contemplating the purchase of a new leather sewing machine to replace the existing machine. The existing machine was purchased four years ago at an installed cost of $115,000; it was being depreciated under MACRS using a 5-year recovery period. The existing machine is expected to have a useful life of 5 more years. The new machine costs $203,000 and requires $8,000 in installation costs; it has a five-year useable life and would be depreciated under MACRS using 5-year recovery period. Canal can currently sell the existing machine for $52,000 without incurring any removal or cleanup costs. To support the increased business resulting from the purchase of the new machine, accounts receivable would increase by $63,000, inventories by $12,000, and accounts payable by $72,000. At the end of 5 years, the existing machine is expected to have a market value of zero; the new machine would be sold to net $66,000 after removal and cleanup costs and before taxes. The firm is subject to a 33% tax rate and a WACC of 13.36%. The estimated earnings before depreciation, interest and taxes over the 5 years for both the new and existing machine are attached. Should Canal Company invest in the new machine?