Home /

Expert Answers /

Accounting /

case-study-retirement-planning-john-is-a-30-year-old-professional-planning-for-his-retirement-pa834

(Solved): Case Study - Retirement Planning John is a 30-year-old professional planning for his retirement ...

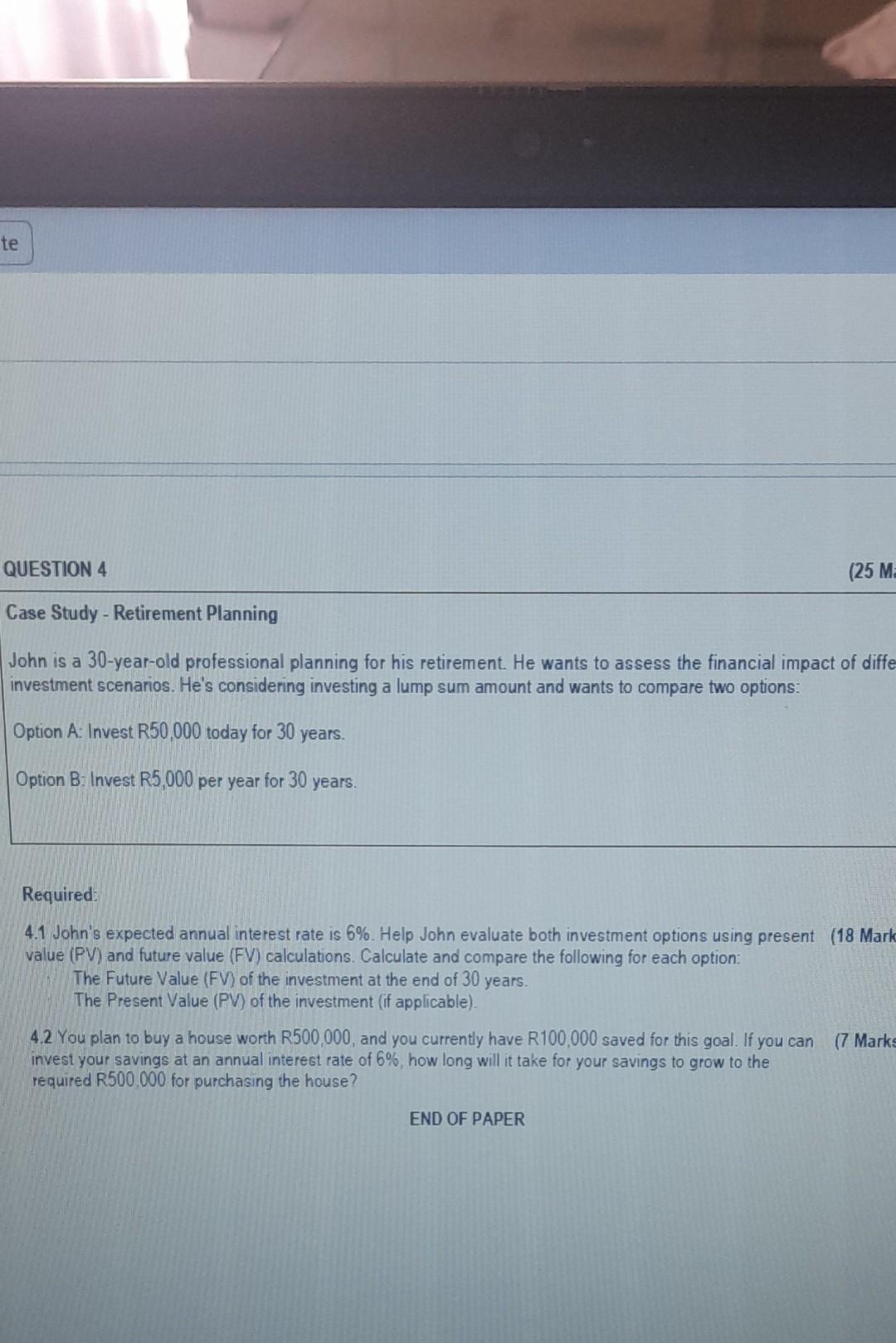

Case Study - Retirement Planning John is a 30-year-old professional planning for his retirement. He wants to assess the financial impact of diffe investment scenarios. He's considering investing a lump sum amount and wants to compare two options: Option A: Invest R50,000 today for 30 years. Option B- Invest per year for 30 years. Required: 4.1 John's expected annual interest rate is . Help John evaluate both investment options using present (18 Mark value (PV) and future value (FV) calculations. Calculate and compare the following for each option: The Future Value (FV) of the investment at the end of 30 years. The Present Value (PV) of the investment (if applicable). 4.2 You plan to buy a house worth R500,000, and you currently have R100,000 saved for this goal. If you can (7 Mark invest your savings at an annual interest rate of , how long will it take for your savings to grow to the required for purchasing the house? END OF PAPER