Home /

Expert Answers /

Economics /

competitive-monetary-equilibrium-in-a-growing-economy-with-money-supply-growth-30-refer-to-theor-pa915

(Solved): Competitive Monetary Equilibrium in a Growing Economy with Money Supply Growth (30%). Refer to Theor ...

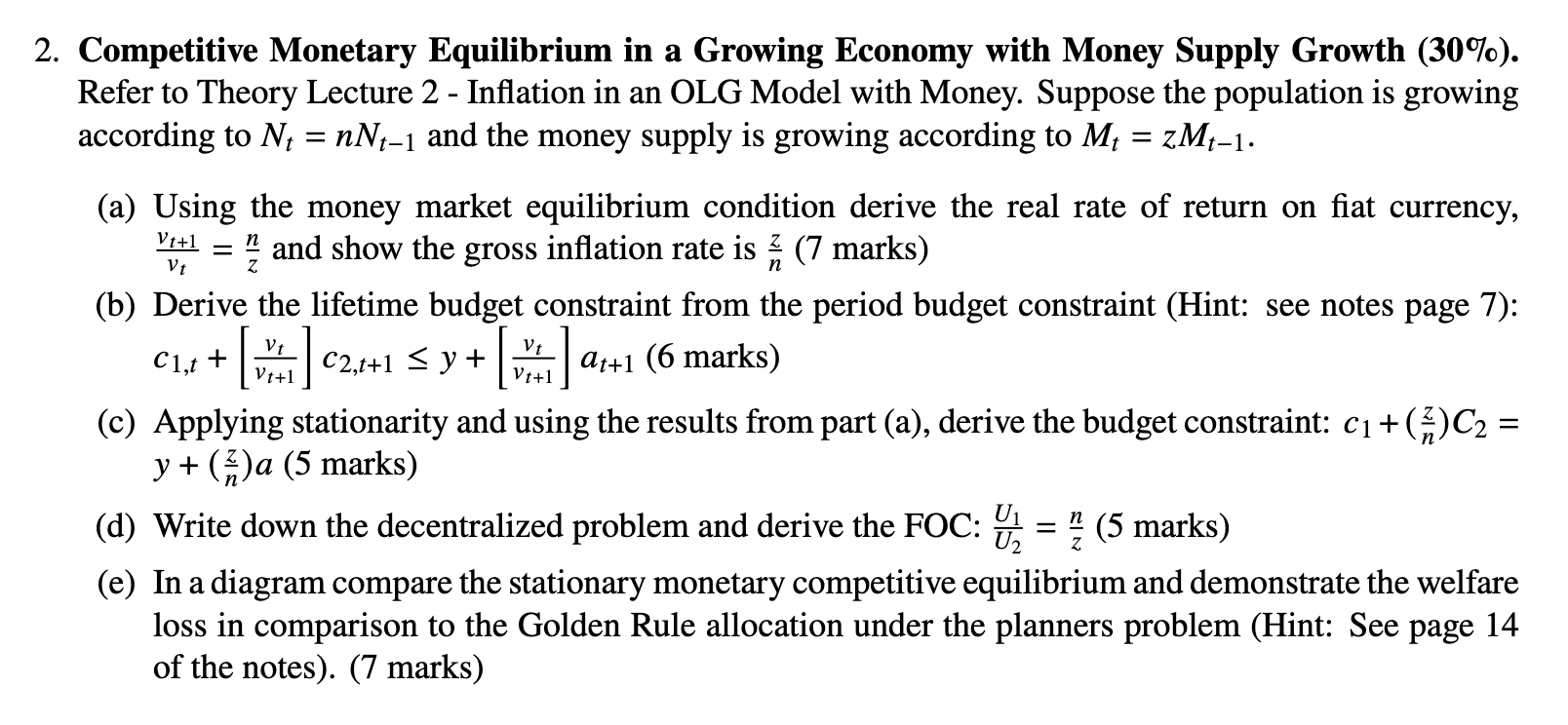

Competitive Monetary Equilibrium in a Growing Economy with Money Supply Growth (30%).

Refer to Theory Lecture 2 - Inflation in an OLG Model with Money. Suppose the population is growing

according to N_(t)=nN_(t-1) and the money supply is growing according to M_(t)=zM_(t-1).

(a) Using the money market equilibrium condition derive the real rate of return on fiat currency,

(v_(t+1))/(v_(t))=(n)/(z) and show the gross inflation rate is (z)/(n) (7 marks)

(b) Derive the lifetime budget constraint from the period budget constraint (Hint: see notes page 7):

c_(1,t)+[(v_(t))/(v_(t+1))]c_(2,t+1)<=y+[(v_(t))/(v_(t+1))]a_(t+1)(6 marks )

(c) Applying stationarity and using the results from part (a), derive the budget constraint: c_(1)+((z)/(n))C_(2)=

y+((z)/(n))a (5 marks)

(d) Write down the decentralized problem and derive the FOC: (U_(1))/(U_(2))=(n)/(z) (5 marks)

(e) In a diagram compare the stationary monetary competitive equilibrium and demonstrate the welfare

loss in comparison to the Golden Rule allocation under the planners problem (Hint: See page 14

of the notes). (7 marks)

[Please provide detailed explanations and the rationale behind as I really need that; thank you!!]