(Solved): Compute MV Corporation's 2022 taxable income given the following information relating to its year 1 ...

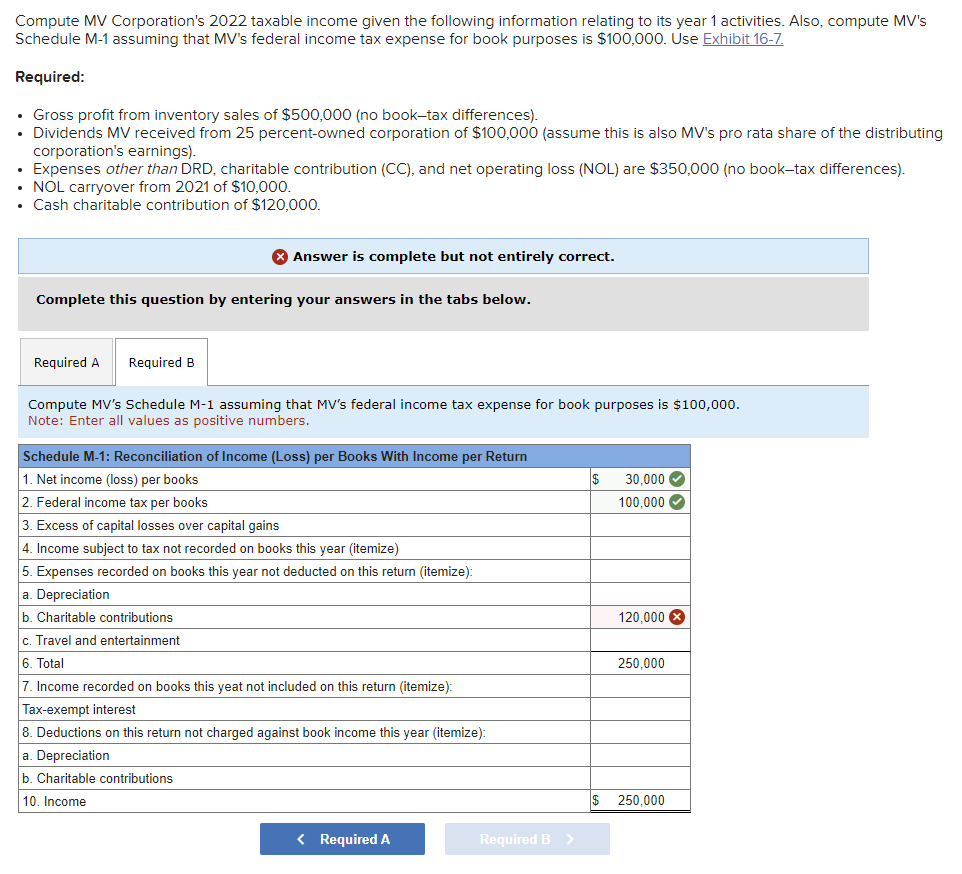

Compute MV Corporation's 2022 taxable income given the following information relating to its year 1 activities. Also, compute MV's Schedule M-1 assuming that MV's federal income tax expense for book purposes is

$100,000. Use Exhibit 16-7. Required: Gross profit from inventory sales of

$500,000(no book-tax differences). Dividends MV received from 25 percent-owned corporation of

$100,000(assume this is also MV's pro rata share of the distributing corporation's earnings). Expenses other than DRD, charitable contribution (CC), and net operating loss (NOL) are

$350,000(no book-tax differences). NOL carryover from 2021 of

$10,000. Cash charitable contribution of

$120,000. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Compute MV's Schedule M-1 assuming that MV's federal income tax expense for book purposes is

$100,000. Note: Enter all values as positive numbers.