(Solved): Compute ratios. Refer to the financial yardsticks as suggested by Sun Company to determine the attra ...

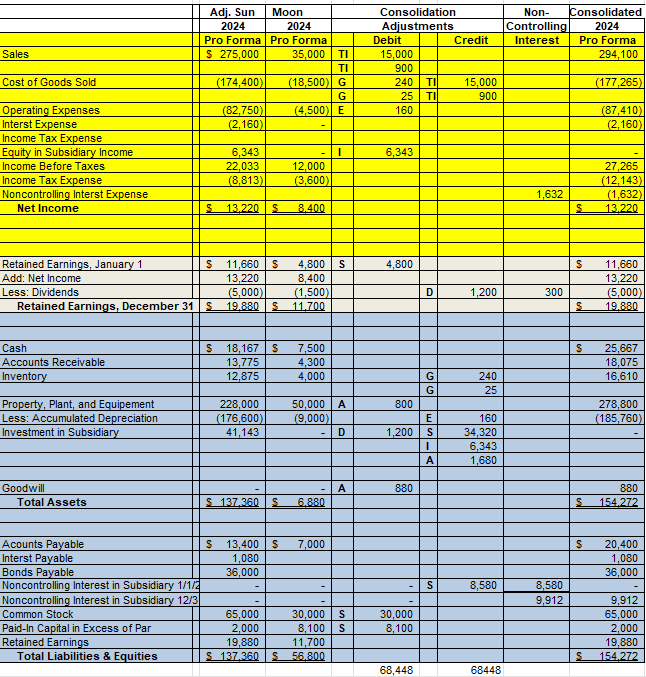

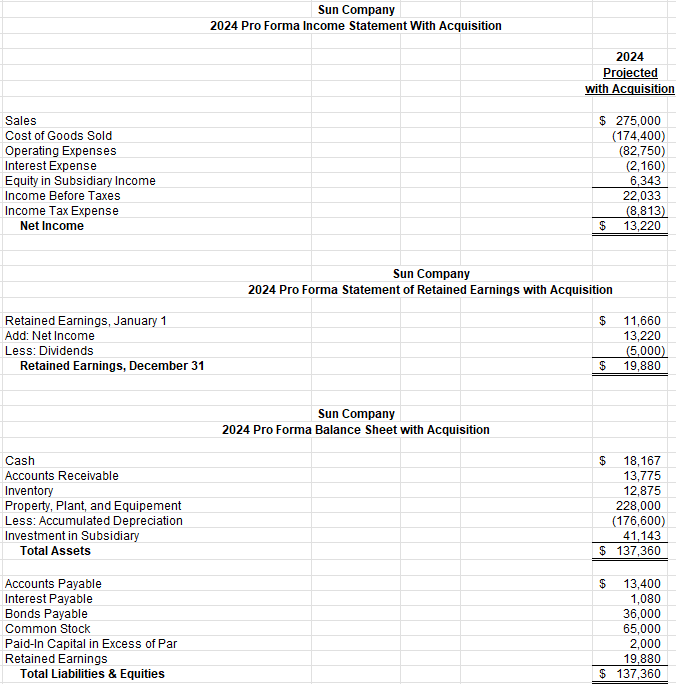

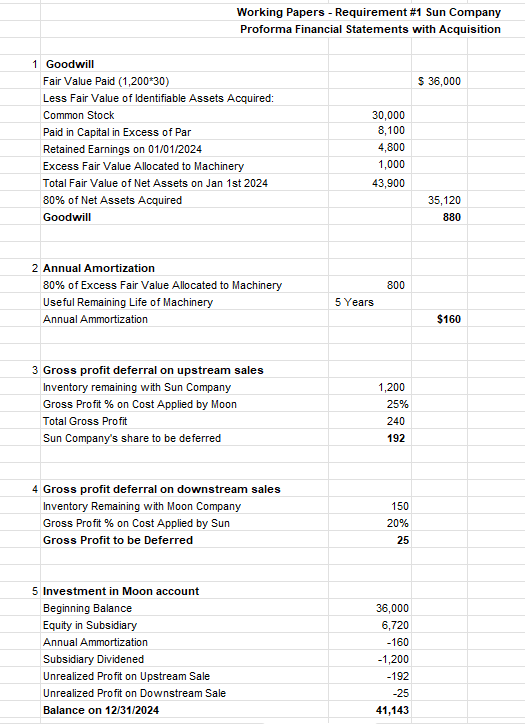

Compute ratios. Refer to the financial yardsticks as suggested by Sun Company to determine the attractiveness of the acquisition (suggested financial yardsticks are available in the Additional Information) to compute ratios. Additional Information As of January 1, 2024, all of Moon Company's assets and liabilities are fairly valued except for machinery with a book value of $5,000, an estimated fair value of $6,000, and a 5-year remaining useful life. Assume that straight-line depreciation is used to amortize any revaluation increment. No transactions between these companies occurred prior to 2024. Regardless of whether they combine, Sun Company plans to buy $15,000 of merchandise from Moon Company in 2024 and will have $1,200 of these purchases remaining in inventory on December 31, 2024. In addition, Moon is expected to buy $900 of merchandise from Sun in 2024 and to have $150 of these purchases in inventory on December 31, 2024. Sun and Moon price their products to yield a 20% and 25% markup on cost, respectively. Sun Company intends to use three financial yardsticks to determine the financial attractiveness of the combination. First, Sun wishes to acquire Moon only if 2024 consolidated earnings per share will be at least as high as the earnings per share Sun would report if no combination takes place. Second, Sun will consider the proposed combination unattractive if it will cause the consolidated current ratio to fall below two to one. Third, return on average stockholders' equity must remain above 20% for the combined entity. If the financial yardsticks described above and the nonfinancial aspects of the combination are appealing, then the tender offer will be made. On the other hand, if these objectives are not met, the acquisition will either be restructured or abandoned \begin{tabular}{|l|l|l|l|l|l|l|l|l|} \hline & Adj. Sun & Moon & \multicolumn{4}{|c|}{Consolidation} & Non- & Consolidated \\ \hline & 2024 & 2024 & \multicolumn{4}{|c|}{Adjustments} & Controlling & 2024 \\ \hline & Pro Forma & Pro Forma & & Debit & & Credit & Interest & Pro Forma \\ \hline Sales & \$ 275,000 & 35,000 & TI & 15,000 & & & & 294,100 \\ \hline & & & TI & 900 & & & & \\ \hline Cost of Goods Sold & \( (174,400) \) & \( (18,500) \) & G & 240 & TI & 15,000 & & \( (177,265) \) \\ \hline & & & G & 25 & TI & 900 & & \\ \hline Operating Expenses & \( (82,750) \) & \( (4,500) \) & E & 160 & & & & \( (87,410) \) \\ \hline Interst Expense & \( (2,160) \) & - & & & & & & \( (2,160) \) \\ \hline Income Tax Expense & & & & & & & & \\ \hline Equity in Subsidiary Income & 6,343 & - & I & 6,343 & & & & - \\ \hline Income Before Taxes & 22,033 & 12,000 & & & & & & 27,265 \\ \hline Income Tax Expense & \( (8,813) \) & \( (3,600) \) & & & & & & \( (12,143) \) \\ \hline Noncontrolling Interst Expense & & & & & & & 1,632 & \( (1,632) \) \\ \hline Net Income & \$ 13,220 & \$ 8,400 & & & & & & \$ 13,220 \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline & & & & & & & & \\ \hline Retained Earning \begin{tabular}{|l|l|l|l|} \hline Requirement 3 - Ratio Analysis & & & \\ \hline & & & \\ \hline & Sun w/o Acq & & Consolidated \\ \hline & Pro Forma & & Statements \\ \hline & \( \underline{2024} \) & & \( \underline{2024} \) \\ \hline Earnings Per Share= & 2.146 & & 3.3 \\ \hline & & & \\ \hline & & & \\ \hline EPS & Net Income & \( I \) & Shares Outstanding \\ \hline & & & \\ \hline & & & \\ \hline & Sun w/o Acq & & Consolidated \\ \hline & Pro Forma & & Statements \\ \hline & \( \underline{2024} \) & & \( \underline{2024} \) \\ \hline Current Ratio= & 3.494 & & 2.548 \\ \hline & & & \\ \hline & & & \\ \hline Current Ratio & Current Assets & \( I \) & Current Liabilities \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & Sun w/o Acq & & Consolidated \\ \hline & Pro Forma & & Statements \\ \hline & \( \underline{2024} \) & & \( \underline{2024} \) \\ \hline Return on Average Stockholders Equity= & 12.978 & & 19.956 \\ \hline & & & \\ \hline & & & \\ \hline Return on Average Stockholders Equity & Net Income & \( I \) & Average Equity \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline Average Stockholders' Equity & & & \\ \hline Beginning Of Year & & & \\ \hline Common Stock & & & \\ \hline Paid