Home /

Expert Answers /

Accounting /

current-attempt-in-progress-marin-ltd-is-constructing-a-building-construction-began-on-february-1-pa258

(Solved): Current Attempt in Progress Marin Ltd. is constructing a building. Construction began on February 1 ...

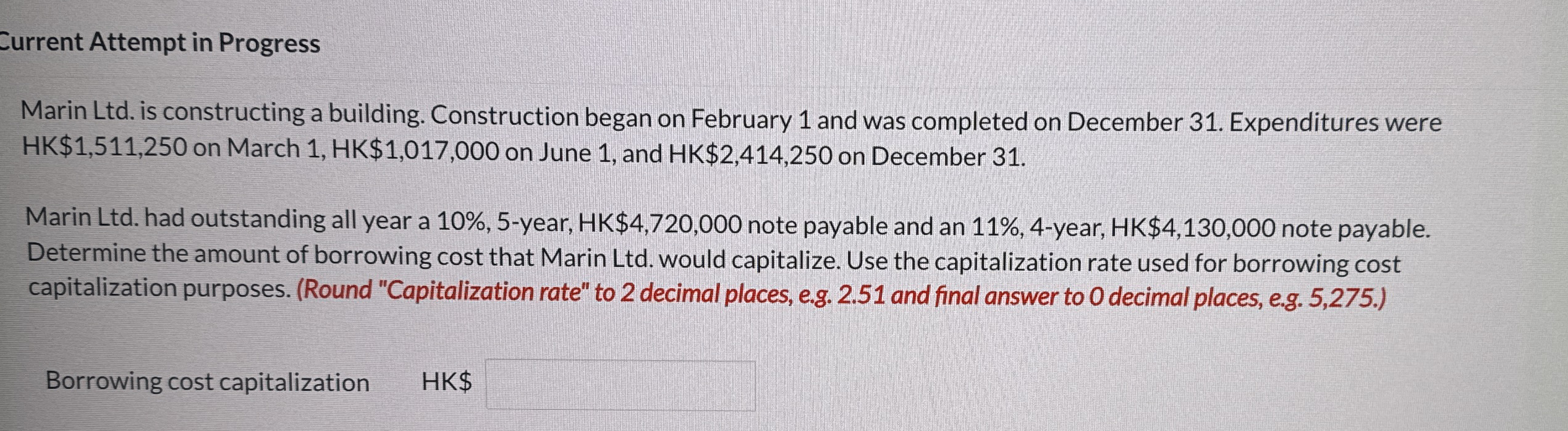

Current Attempt in Progress Marin Ltd. is constructing a building. Construction began on February 1 and was completed on December 31. Expenditures were HK$1,511,250 on March 1, HK$1,017,000 on June 1, and HK$2,414,250 on December 31. Marin Ltd. had outstanding all year a 10%, 5-year, HK$4,720,000 note payable and an 11%, 4-year, HK$4,130,000 note payable. Determine the amount of borrowing cost that Marin Ltd. would capitalize. Use the capitalization rate used for borrowing cost capitalization purposes. (Round "Capitalization rate" to 2 decimal places, e.g. 2.51 and final answer to 0 decimal places, e.g. 5,275.) Borrowing cost capitalization HK$

?