Home /

Expert Answers /

Accounting /

debt-to-assets-ratios-1-calculate-the-quality-of-the-debt-to-assets-ratios-for-coca-cola-company-pa231

(Solved): Debt-to-Assets Ratios 1) Calculate the quality of the debt-to-assets ratios for Coca Cola Company. ...

Debt-to-Assets Ratios

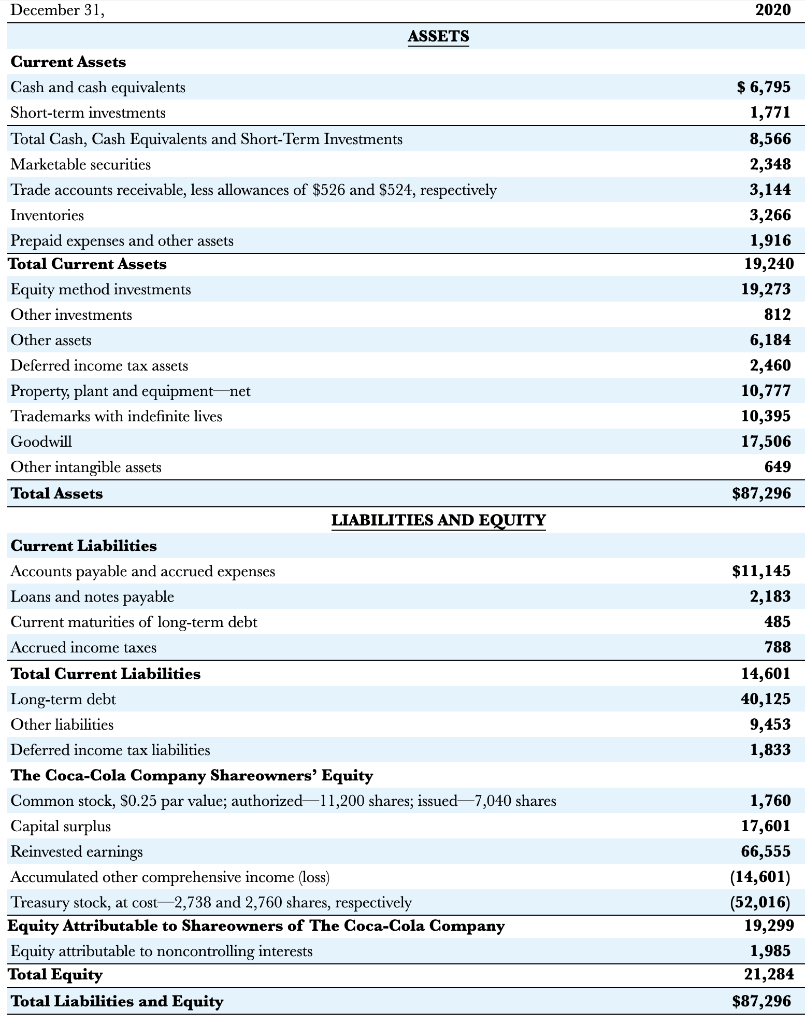

1) Calculate the quality of the debt-to-assets ratios for Coca Cola Company.

2) Explain the quality of the debt-to-assets ratios for the Coca Cola company.

December 31, 2020 Current Assets Cash and cash equivalents ASSETS Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable, less allowances of and , respectively Inventories Prepaid expenses and other assets Total Current Assets \begin{tabular}{r} \\ \\ \hline \\ \\ \\ \end{tabular} Equity method investments Other investments Other assets Deferred income tax assets Property, plant and equipment net Trademarks with indefinite lives Goodwill Other intangible assets Total Assets 19,273 812 Total Assets LIABILITIES AND EQUITY Current Liabilities Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other liabilities Deferred income tax liabilities The Coca-Cola Company Shareowners' Equity \begin{tabular}{lr} Common stock, S0.25 par value; authorized-11,200 shares; issued-7,040 shares & \\ Capital surplus & \\ Reinvested earnings & \\ Accumulated other comprehensive income (loss) & \\ Treasury stock, at cost - 2,738 and 2,760 shares, respectively & \\ \hline Equity Attributable to Shareowners of The Coca-Cola Company & \\ Equity attributable to noncontrolling interests & \\ \hline Total Equity & \\ \hline Total Liabilities and Equity & \\ \hline \end{tabular}

Expert Answer

1) The debt-to-assets ratio for Coca Cola Company is calculated by