Home /

Expert Answers /

Finance /

dickson-corporation-is-comparing-two-different-capital-structures-plan-i-would-result-in-9-000-sha-pa421

(Solved): Dickson Corporation is comparing two different capital structures. Plan I would result in 9,000 sha ...

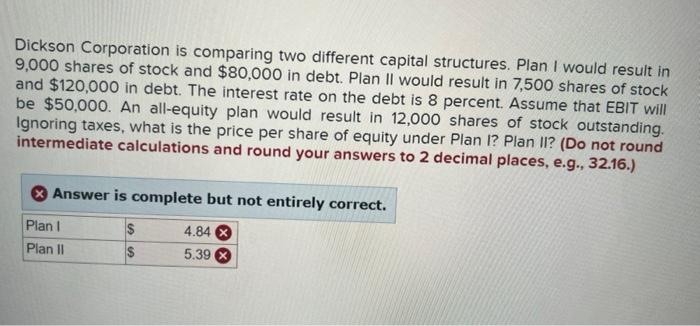

Dickson Corporation is comparing two different capital structures. Plan I would result in 9,000 shares of stock and in debt. Plan II would result in 7,500 shares of stock and in debt. The interest rate on the debt is 8 percent. Assume that EBIT will be . An all-equity plan would result in 12,000 shares of stock outstanding. Ignoring taxes, what is the price per share of equity under Plan I? Plan II? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct.