Home /

Expert Answers /

Operations Management /

ee126-which-of-the-following-gifts-would-be-considered-a-taxable-gift-billy-gave-his-nephew-50-0-pa731

(Solved): (EE126) Which of the following gifts would be considered a taxable gift? Billy gave his nephew $50,0 ...

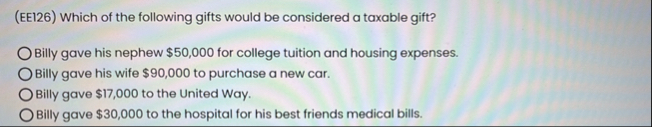

(EE126) Which of the following gifts would be considered a taxable gift? Billy gave his nephew

$50,000for college tuition and housing expenses. Billy gave his wife $90,000 to purchase a new car. Billy gave $17,000 to the United Way. Billy gave

$30,000to the hospital for his best friends medical bills.