(Solved): Exercise 7-26 (Algo) Net Position Classifications [LO 7-5] The Village of Shelburne operates a nine ...

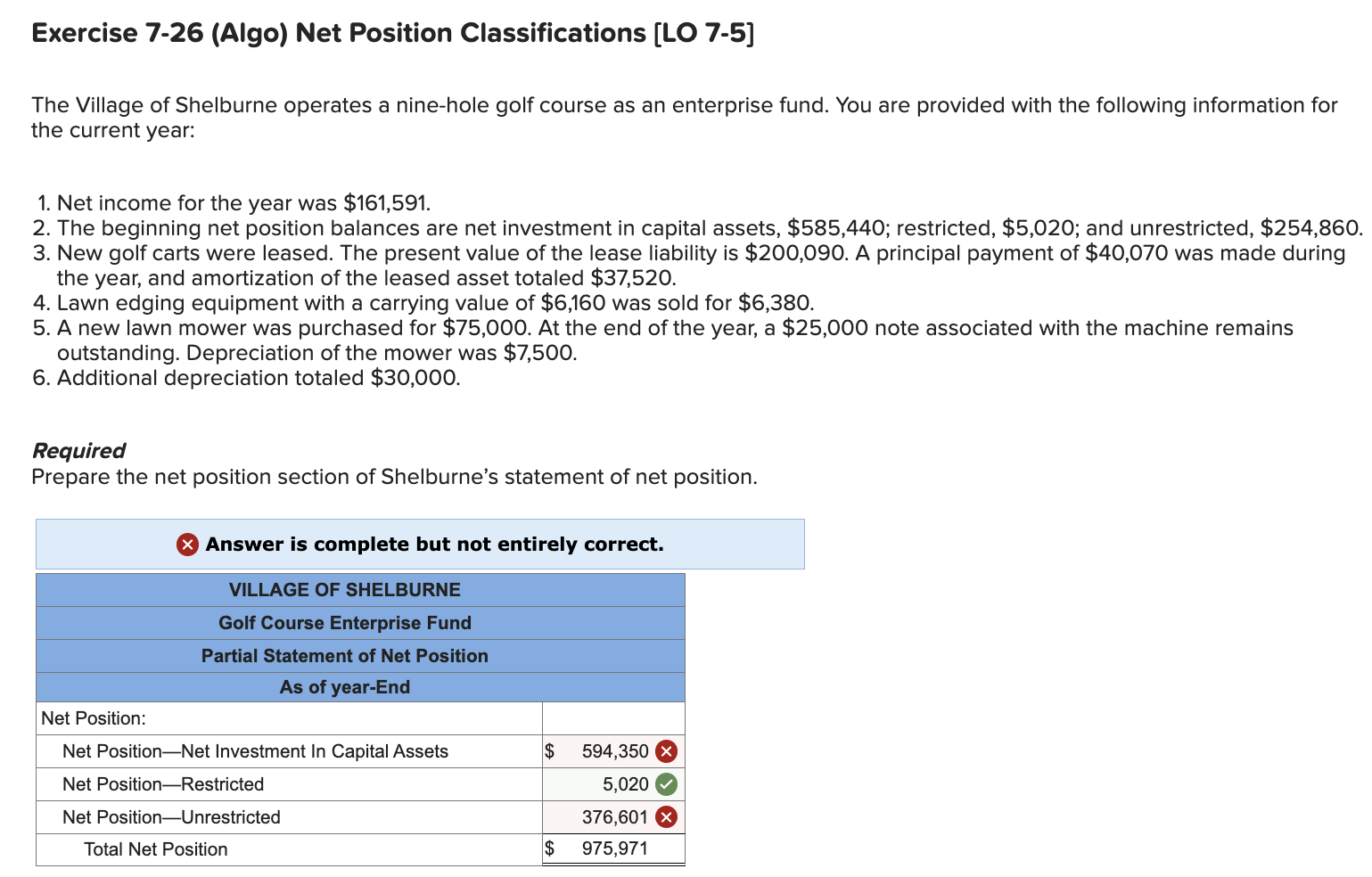

Exercise 7-26 (Algo) Net Position Classifications [LO 7-5] The Village of Shelburne operates a nine-hole golf course as an enterprise fund. You are provided with the following information for the current year: Net income for the year was

$161,591. The beginning net position balances are net investment in capital assets,

$585,440; restricted,

$5,020; and unrestricted,

$254,860. New golf carts were leased. The present value of the lease liability is

$200,090. A principal payment of

$40,070was made during the year, and amortization of the leased asset totaled

$37,520. Lawn edging equipment with a carrying value of

$6,160was sold for

$6,380. A new lawn mower was purchased for

$75,000. At the end of the year, a

$25,000note associated with the machine remains outstanding. Depreciation of the mower was

$7,500. Additional depreciation totaled

$30,000. Required Prepare the net position section of Shelburne's statement of net position. Answer is complete but not entirely correct.