(Solved): Expando, Incorporated, is considering the possibility of building an additional factory that would ...

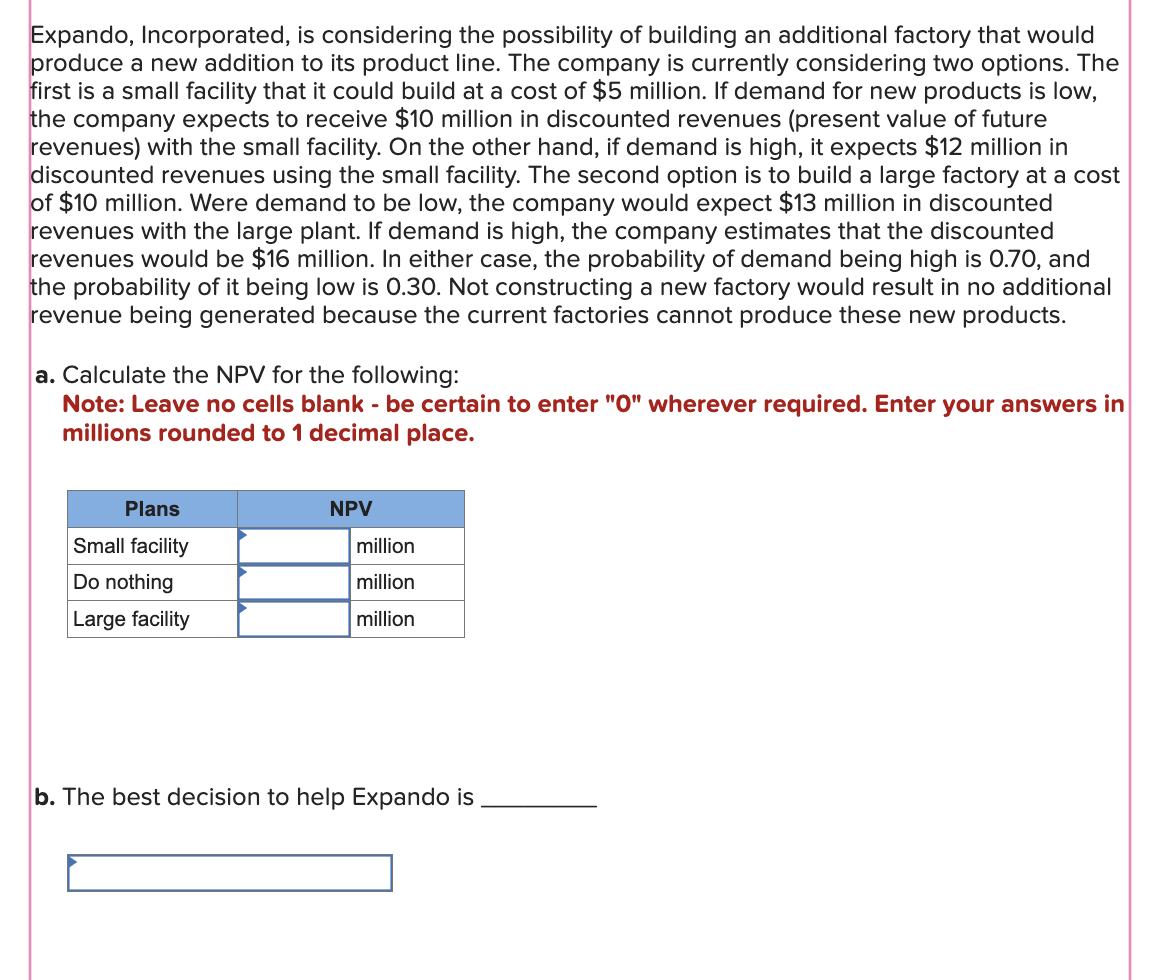

Expando, Incorporated, is considering the possibility of building an additional factory that would produce a new addition to its product line. The company is currently considering two options. The first is a small facility that it could build at a cost of \( \$ 5 \) million. If demand for new products is low, the company expects to receive \( \$ 10 \) million in discounted revenues (present value of future revenues) with the small facility. On the other hand, if demand is high, it expects \( \$ 12 \) million in discounted revenues using the small facility. The second option is to build a large factory at a cost of \( \$ 10 \) million. Were demand to be low, the company would expect \( \$ 13 \) million in discounted revenues with the large plant. If demand is high, the company estimates that the discounted revenues would be \( \$ 16 \) million. In either case, the probability of demand being high is 0.70 , and the probability of it being low is 0.30 . Not constructing a new factory would result in no additional revenue being generated because the current factories cannot produce these new products. a. Calculate the NPV for the following: Note: Leave no cells blank - be certain to enter " 0 " wherever required. Enter your answers in millions rounded to 1 decimal place. b. The best decision to help Expando is