(Solved): Here you will find the income statements and balance sheets for Sears Holdings (SHLD) and Target ...

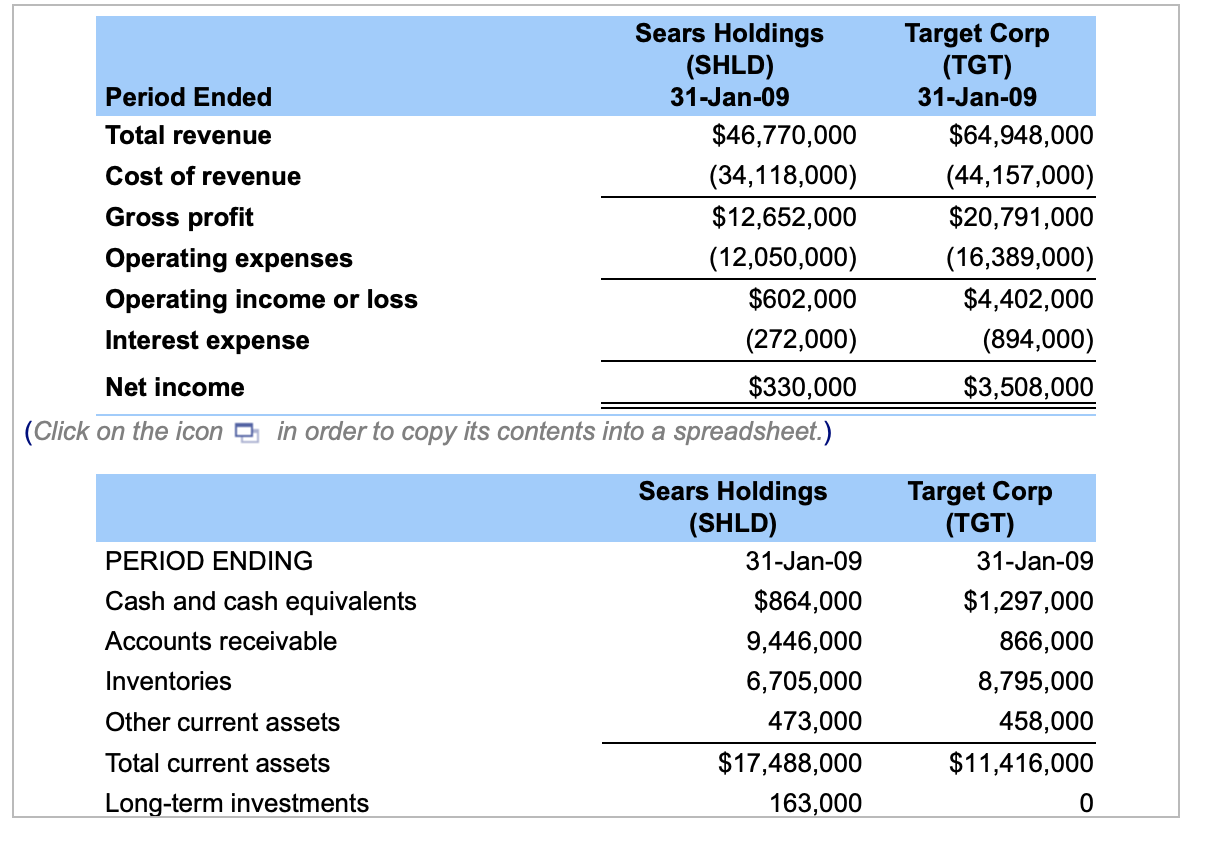

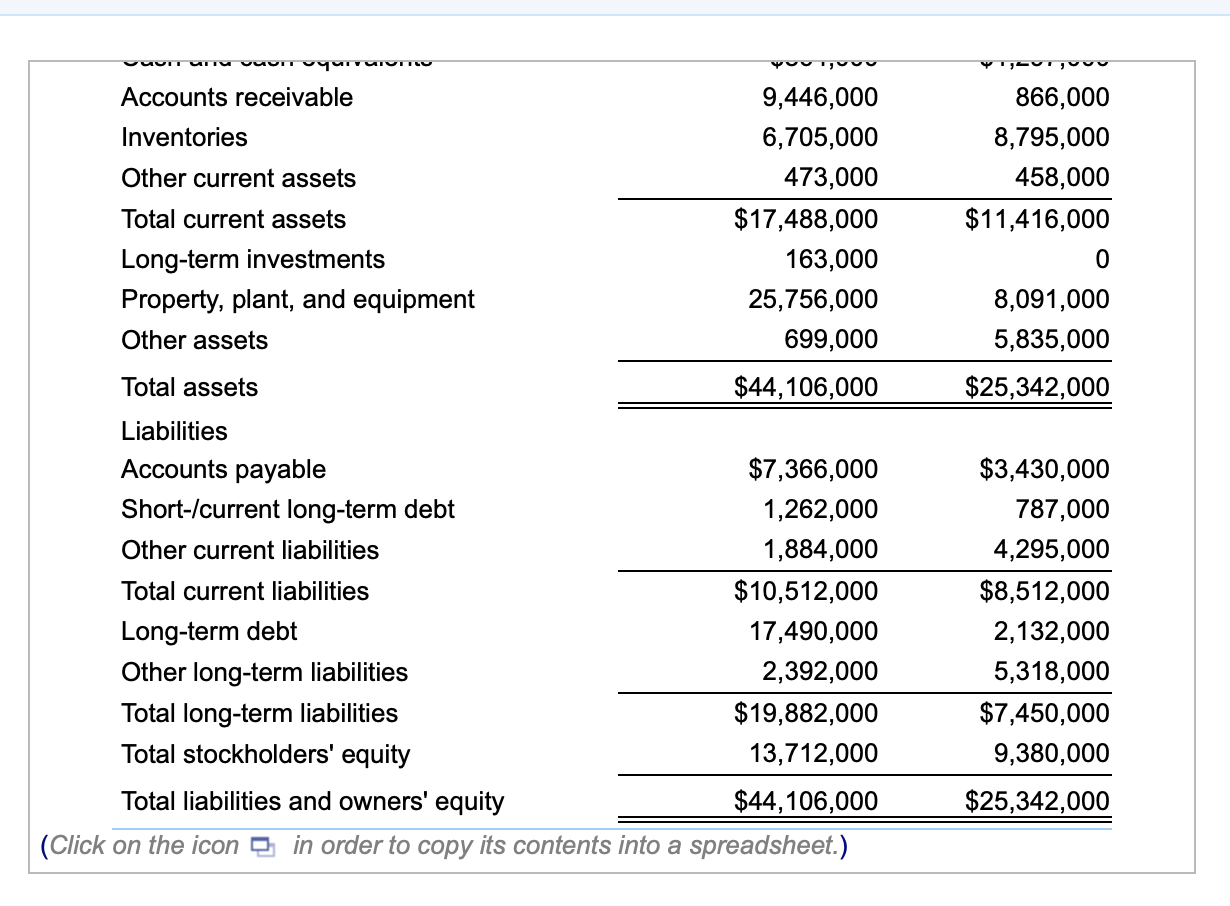

Here you will find the income statements and balance sheets for Sears Holdings? (SHLD) and Target Corp? (TGT). Assume that you are a financial manager at Sears and want to compare your?firm's situation with that of Target. Calculate representative ratios for? liquidity, asset management? efficiency, financial leverage? (capital structure), and profitability for both Sears and Target. How would you summarize the financial performance of Sears compared to Target? (its benchmark? firm)?

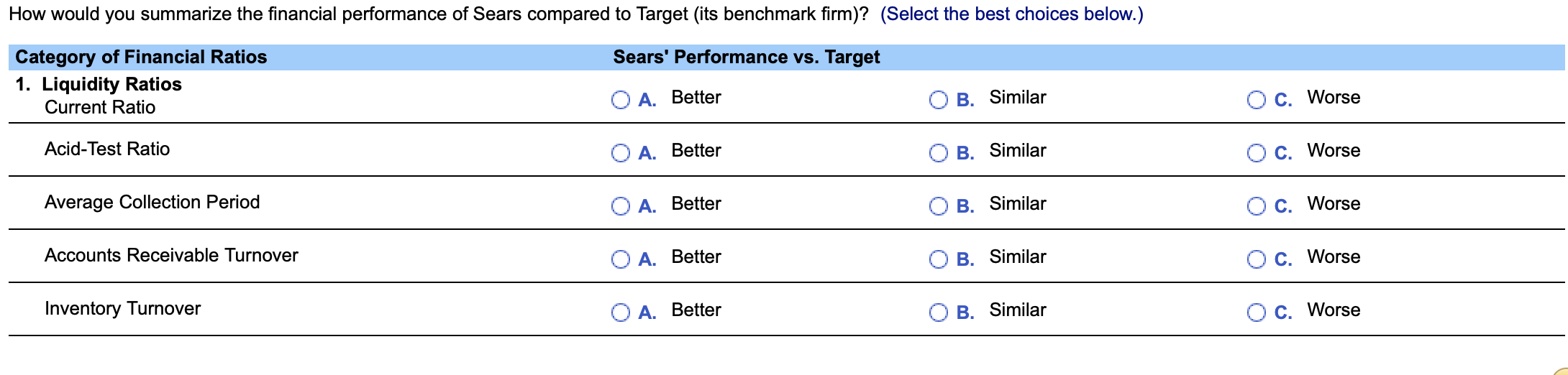

1.??Liquidity Ratios

?Sears' current ratio is ___ times.???(Round to two decimal?places.)

?Target's current ratio is ____ times.???(Round to two decimal?places.)

?Sears' acid-test ratio is _____ times.???(Round to two decimal?places.)

?Target's acid-test ratio is ____ times.???(Round to two decimal? places.)

?Sears' average collection period is _____ days.???(Round to one decimal? place.)

?Target's average collection period is ____ days.???(Round to one decimal? place.)

?Sears' accounts receivable turnover is ____ times.???(Round to one decimal? place.)

?Target's accounts receivable turnover is _____ times.???(Round to one decimal? place.)

?Sears' inventory turnover is _____ times.???(Round to two decimal? places.)

?Target's inventory turnover is _____ times.???(Round to two decimal? places.)

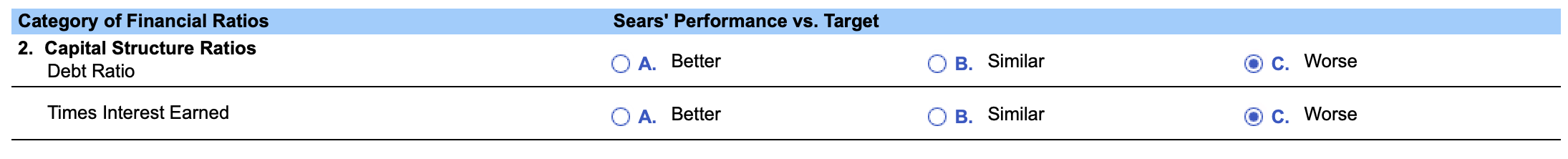

2.??Capital Structure Ratios

?Sears' debt ratio is ____?%. ?(Round to one decimal?place.)

?Target's debt ratio is _____?%. ?(Round to one decimal?place.)

?Sears' times interest earned is ____ times.???(Round to two decimal? places.)

?Target's times interest earned is ____ times.???(Round to two decimal? places.)

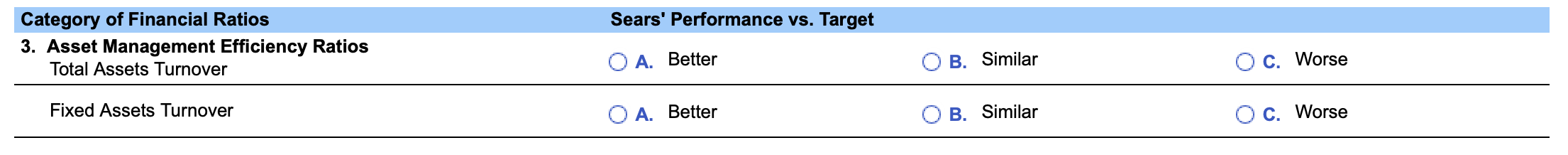

3.??Asset Management Efficiency Ratios

?Sears' total asset turnover is ____ times.???(Round to two decimal? places.)

?Target's total asset turnover is ___ times.???(Round to two decimal? places.)

?Sears' fixed asset turnover is ____ times.???(Round to two decimal? places.)

?Target's fixed asset turnover is ____ times.???(Round to two decimal? places.)

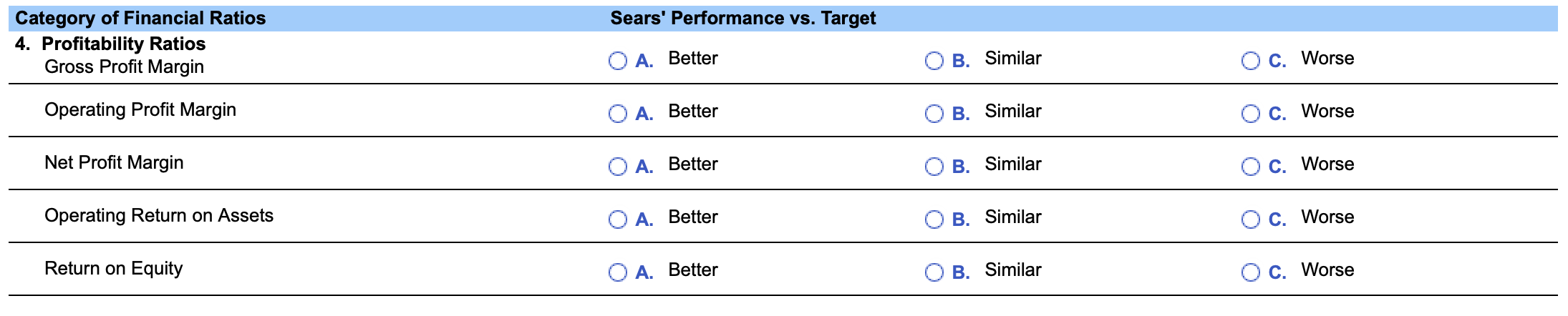

4.??Profitability Ratios

?Sears' gross profit margin is ____?%. ?(Round to one decimal? place.)

?Target's gross profit margin is ____?%. ?(Round to one decimal? place.)

?Sears' operating profit margin is ____%. ?(Round to one decimal? place.)

?Target's operating profit margin is ____%. ?(Round to one decimal? place.)

?Sears' net profit margin is _____?%. ?(Round to one decimal? place.)

?Target's net profit margin is ____?%. ?(Round to one decimal? place.)

?Sears' operating return on assets is ____?%. ?(Round to one decimal? place.)

?Target's operating return on assets is ____?%. ?(Round to one decimal? place.)

?Sears' return on equity is ____%. ?(Round to one decimal?place.)

?Target's return on equity is ____?%. ?(Round to one decimal? place.)

Expert Answer

1. Liquidity Ratios Sears' current ratio is 1.66 times.??(Round to two decimalplaces.) Target's current ratio is 1.34 times.??(Round to two decimalplaces.) Sears' acid-test ratio is 1.02 times.??(Round to two decimalplaces.) Target's acid-test ratio