(Solved): In 2022 Arpen reported a net operating loss of $120,000 for both financial reporting and tax purpose ...

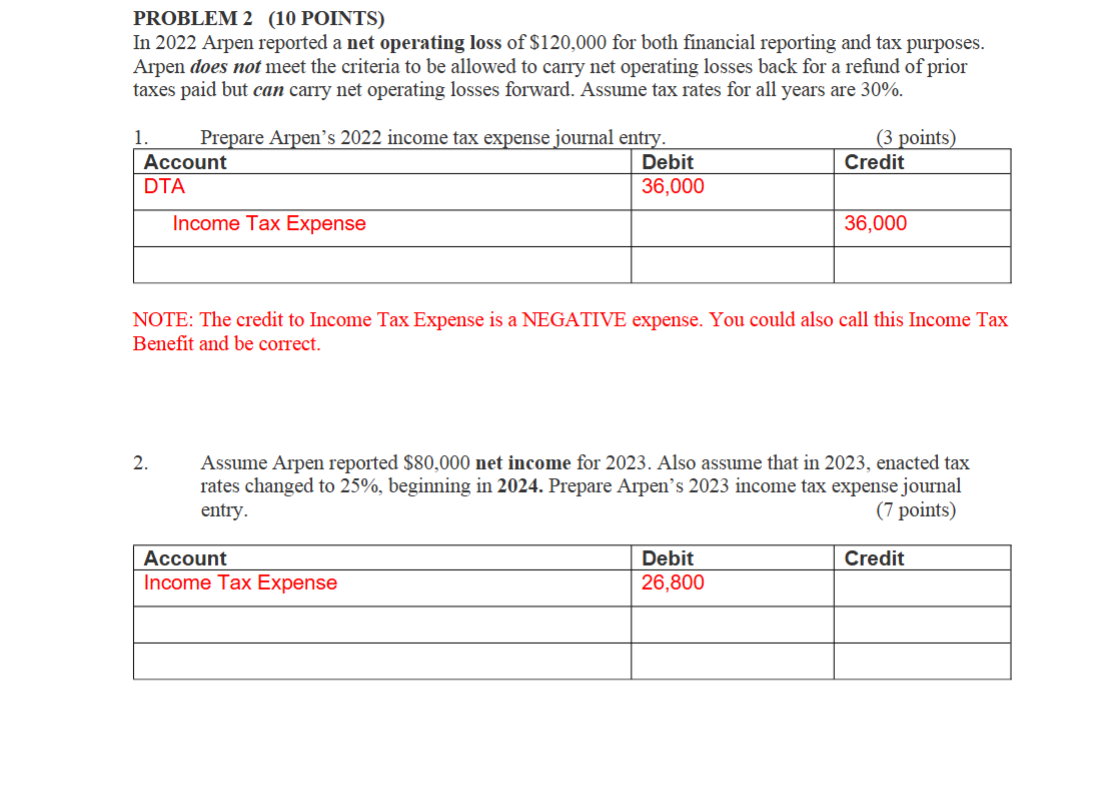

In 2022 Arpen reported a net operating loss of $120,000 for both financial reporting and tax purposes. Arpen does not meet the criteria to be allowed to carry net operating losses back for a refund of prior taxes paid but can carry net operating losses forward. Assume tax rates for all years are 30% Prepare Arpen's 2022 income tax expense journal entry. NOTE: The credit to Income Tax Expense is a NEGATIVE expense. You could also call this Income Tax Benefit and be correct. Assume Arpen reported $80,000 net income for 2023. Also assume that in 2023, enacted tax rates changed to 25%, beginning in 2024. Prepare Arpen's 2023 income tax expense journal entry. Please show work, thank you!