Home /

Expert Answers /

Accounting /

kevin-is-planning-for-his-retirement-this-year-one-option-that-has-been-presented-to-him-is-the-p-pa853

(Solved): Kevin is planning for his retirement this year. One option that has been presented to him is the p ...

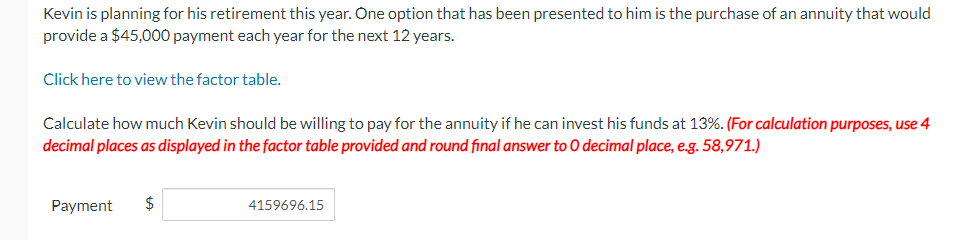

Kevin is planning for his retirement this year. One option that has been presented to him is the purchase of an annuity that would provide a payment each year for the next 12 years. Click here to view the factor table. Calculate how much Kevin should be willing to pay for the annuity if he can invest his funds at 13\%. (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to 0 decimal place, e.g. 58,971.) Payment

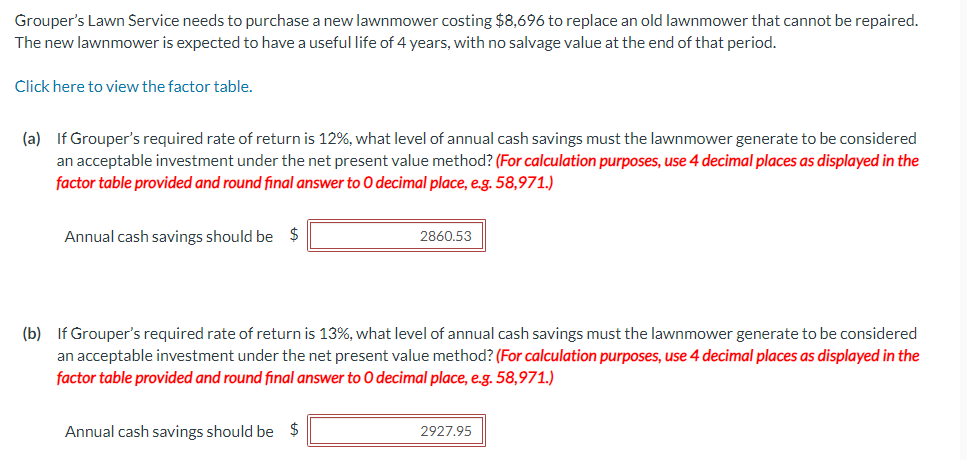

Grouper's Lawn Service needs to purchase a new lawnmower costing to replace an old lawnmower that cannot be repaired. The new lawnmower is expected to have a useful life of 4 years, with no salvage value at the end of that period. Click here to view the factor table. (a) If Grouper's required rate of return is , what level of annual cash savings must the lawnmower generate to be considered an acceptable investment under the net present value method? (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to 0 decimal place, e.g. 58,971.) Annual cash savings should be (b) If Grouper's required rate of return is , what level of annual cash savings must the lawnmower generate to be considered an acceptable investment under the net present value method? (For calculation purposes, use 4 decimal places as displayed in the factor table provided and round final answer to 0 decimal place, e.g. 58,971 .) Annual cash savings should be

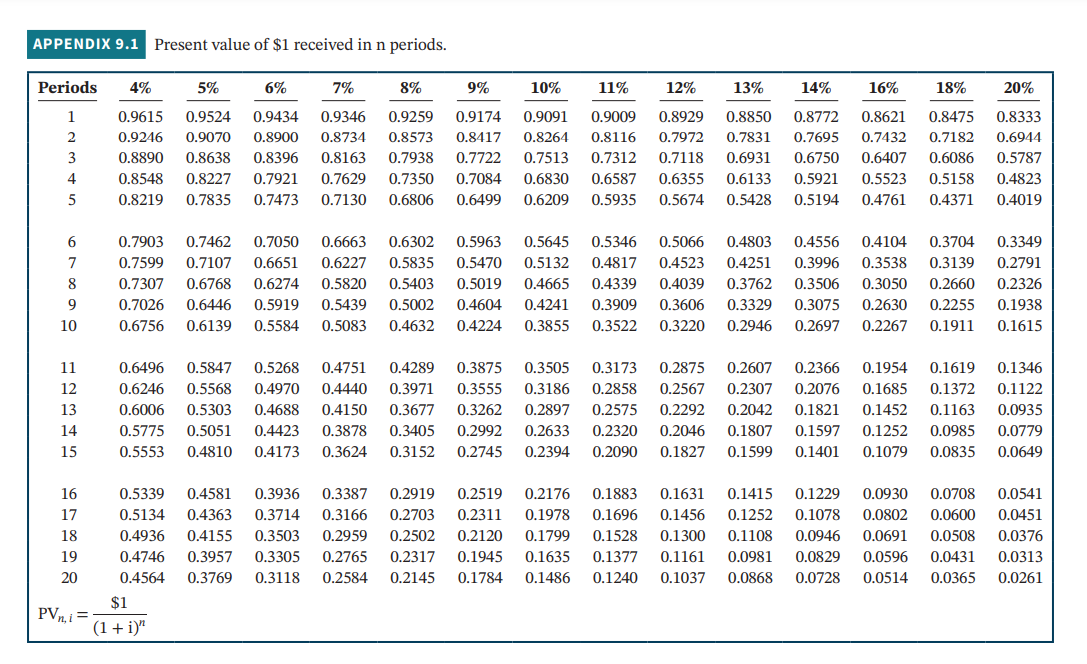

Present value of received in periods.

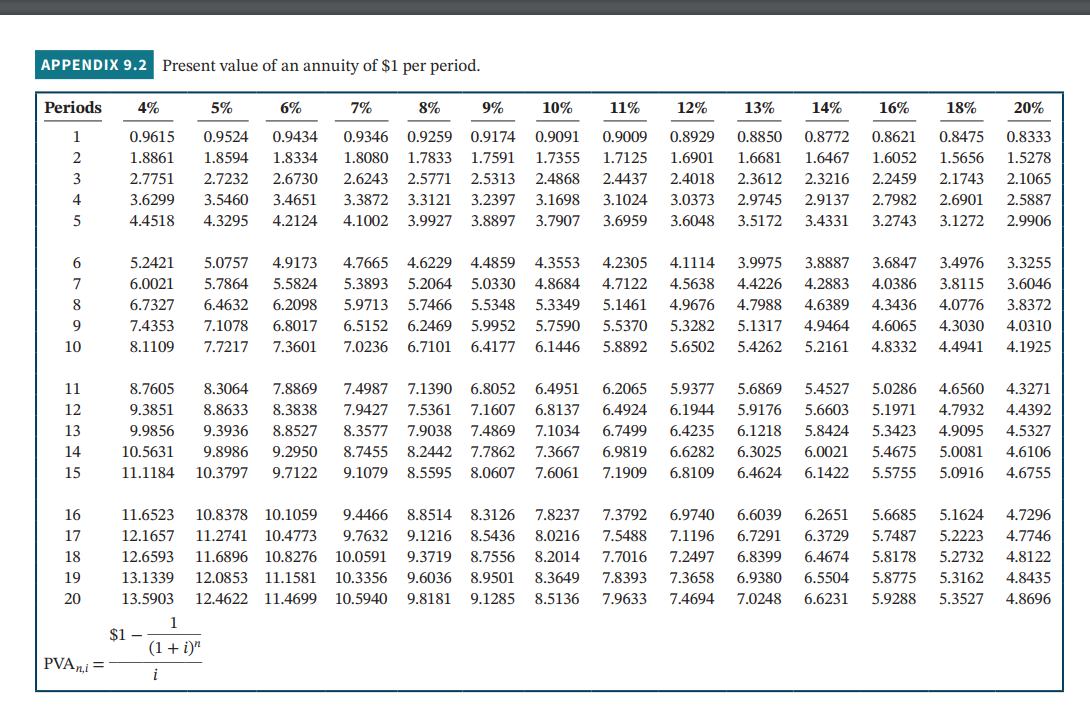

Present value of an annuity of per period.