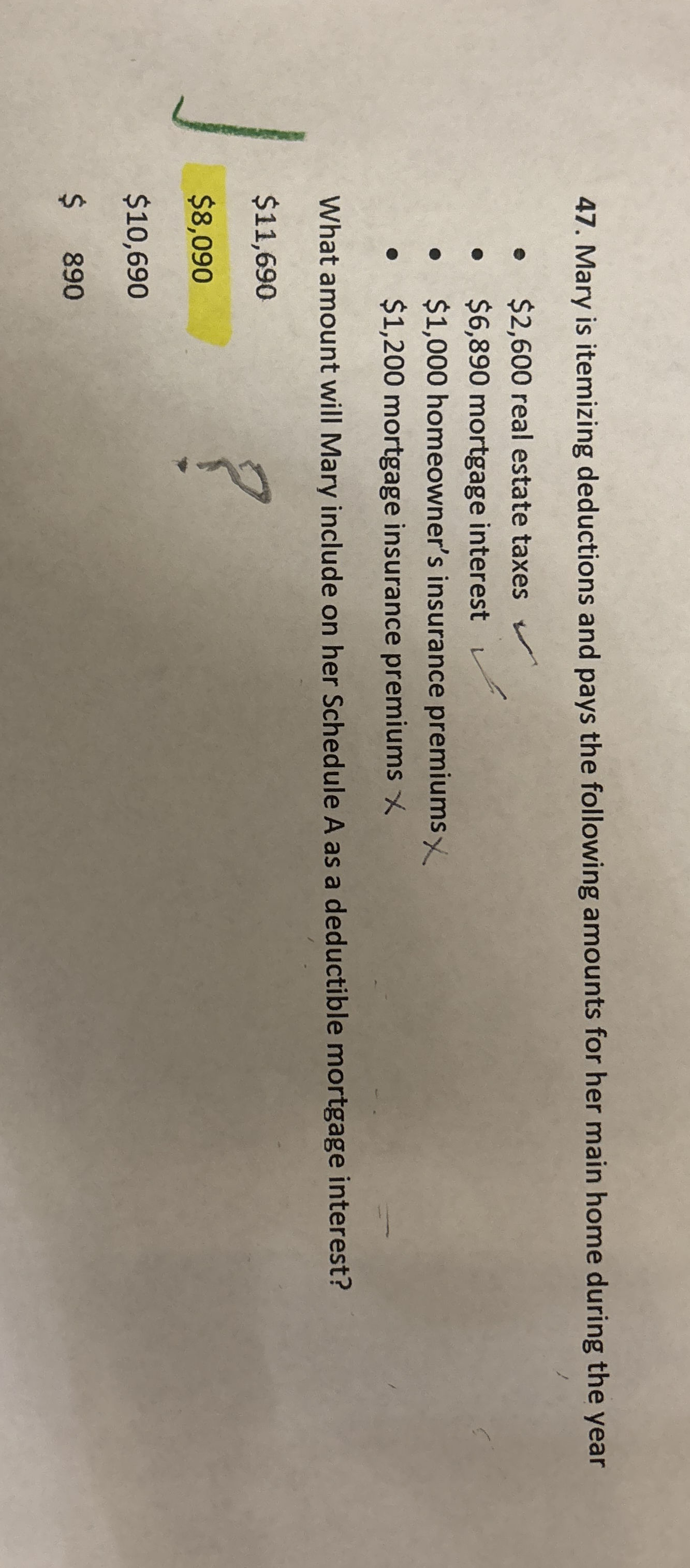

(Solved): Mary is itemizing deductions and pays the following amounts for her main home during the year $2,600 ...

Mary is itemizing deductions and pays the following amounts for her main home during the year $2,600 real estate taxes $6,890 mortgage interest $1,000 homeowner's insurance premiums $1,200 mortgage insurance premiums What amount will Mary include on her Schedule A as a deductible mortgage interest? $11,690 $8,090 $10,690 $ 890