Home /

Expert Answers /

Accounting /

nbsp-psb-3-5-calculate-federal-income-tax-withholding-using-two-methods-pre-2020-form-w-4-for-pa689

(Solved): PSb 3-5 Calculate Federal Income Tax Withholding Using Two Methods (Pre-2020 Form W-4) For ...

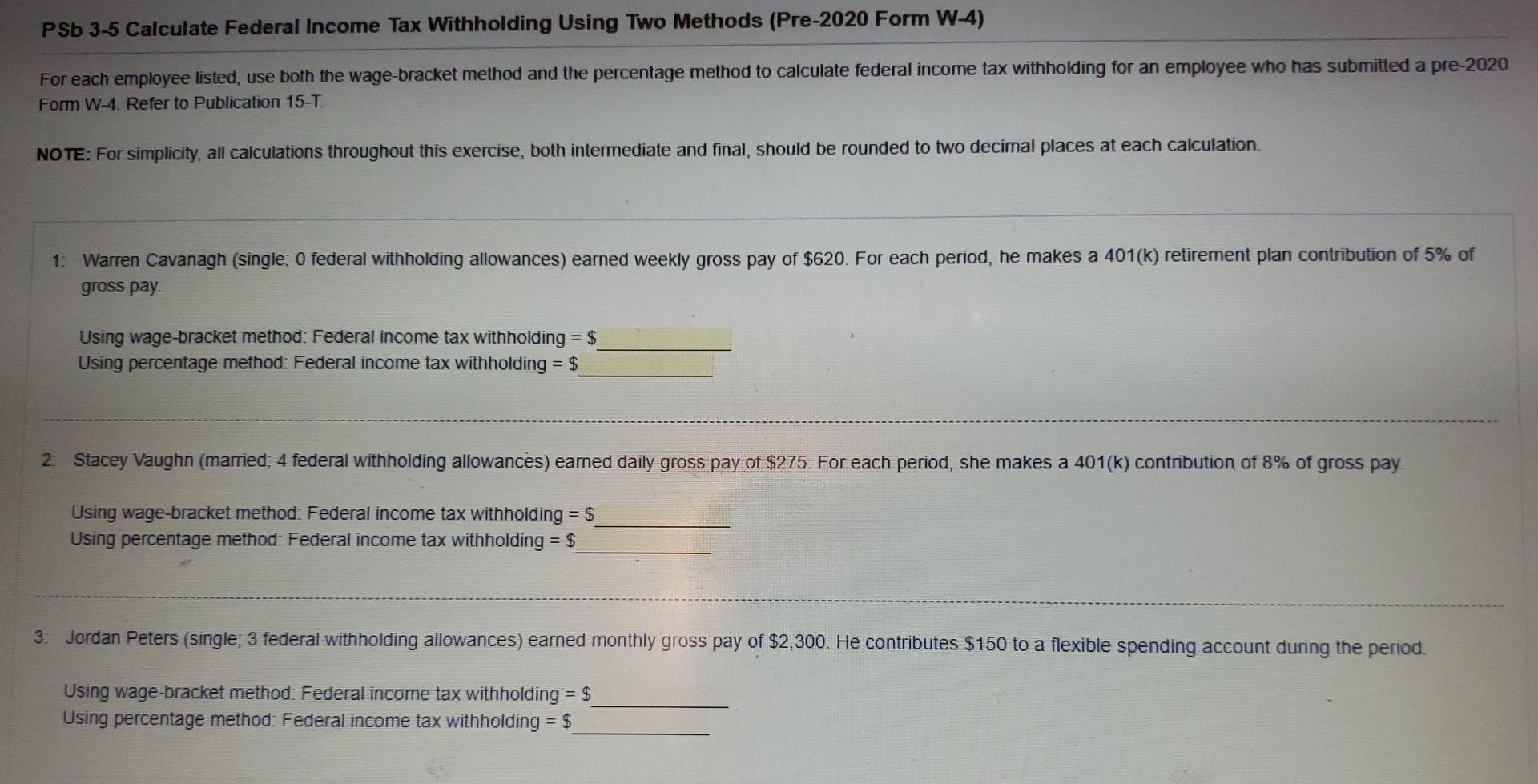

PSb 3-5 Calculate Federal Income Tax Withholding Using Two Methods (Pre-2020 Form W-4) For each employee listed, use both the wage-bracket method and the percentage method to calculate federal income tax withholding for an employee who has submitted a pre-2020 Form W-4. Refer to Publication 15-T. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. 1: Warren Cavanagh (single; O federal withholding allowances) earned weekly gross pay of $620. For each period, he makes a 401(k) retirement plan contribution of 5% of gross pay. Using wage-bracket method: Federal income tax withholding = $ Using percentage method: Federal income tax withholding = $ 2: Stacey Vaughn (married; 4 federal withholding allowances) earned daily gross pay of $275. For each period, she makes a 401(k) contribution of 8% of gross pay. Using wage-bracket method: Federal income tax withholding = $ Using percentage method: Federal income tax withholding = $ 3: Jordan Peters (single; 3 federal withholding allowances) earned monthly gross pay of $2,300. He contributes $150 to a flexible spending account during the period. Using wage-bracket method: Federal income tax withholding = $ Using percentage method: Federal income tax withholding = $