Home /

Expert Answers /

Economics /

now-consider-the-ramsey-model-with-a-cobb-douglas-aggregate-production-function-y-k-alpha-pa421

(Solved): Now consider the Ramsey model with a Cobb-Douglas aggregate production function, \( y=k^{\alpha} \ ...

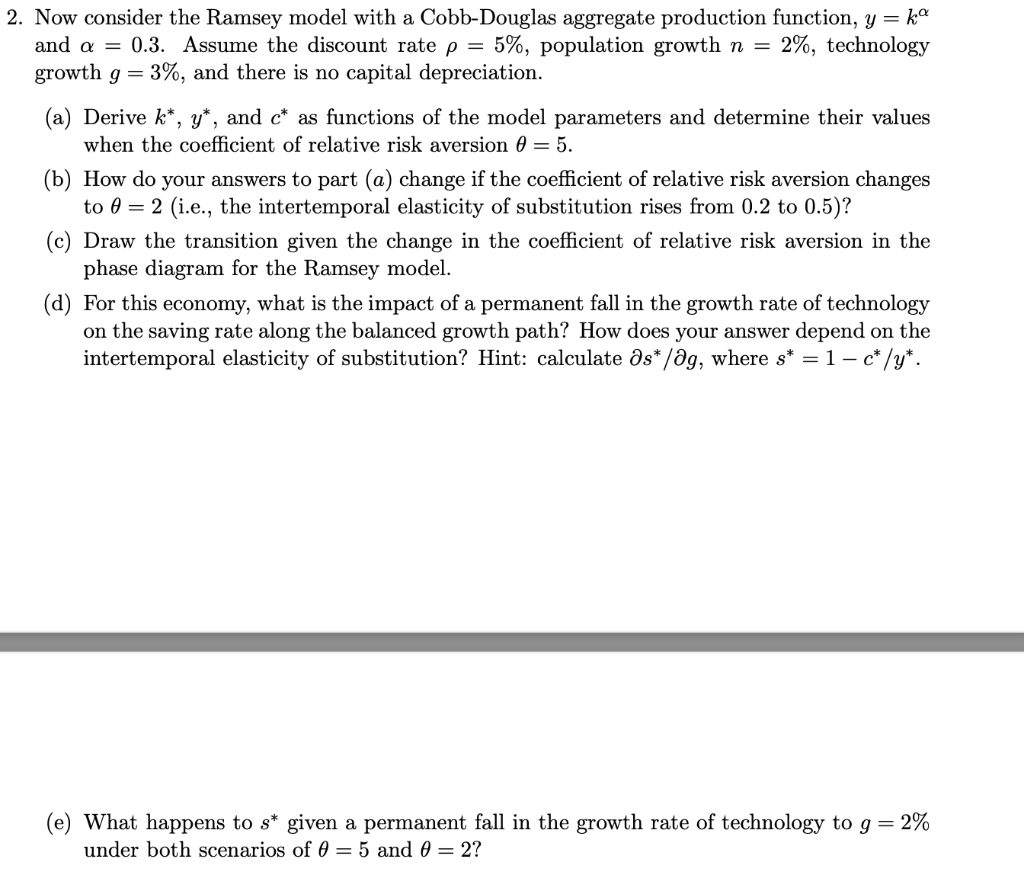

Now consider the Ramsey model with a Cobb-Douglas aggregate production function, \( y=k^{\alpha} \) and \( \alpha=0.3 \). Assume the discount rate \( \rho=5 \% \), population growth \( n=2 \% \), technology growth \( g=3 \% \), and there is no capital depreciation. (a) Derive \( k^{*}, y^{*} \), and \( c^{*} \) as functions of the model parameters and determine their values when the coefficient of relative risk aversion \( \theta=5 \). (b) How do your answers to part \( (a) \) change if the coefficient of relative risk aversion changes to \( \theta=2 \) (i.e., the intertemporal elasticity of substitution rises from \( 0.2 \) to \( 0.5 \) )? (c) Draw the transition given the change in the coefficient of relative risk aversion in the phase diagram for the Ramsey model. (d) For this economy, what is the impact of a permanent fall in the growth rate of technology on the saving rate along the balanced growth path? How does your answer depend on the intertemporal elasticity of substitution? Hint: calculate \( \partial s^{*} / \partial g \), where \( s^{*}=1-c^{*} / y^{*} \). (e) What happens to \( s^{*} \) given a permanent fall in the growth rate of technology to \( g=2 \% \) under both scenarios of \( \theta=5 \) and \( \theta=2 \) ?

Expert Answer

Answer) We know that k=capital & f(k,l) Y=ka where a=0.3 so, y=k0.3 and the growth of output is 3% so n+g = 0.03 The depreciation is given nil. The capital- output ratio=k/y