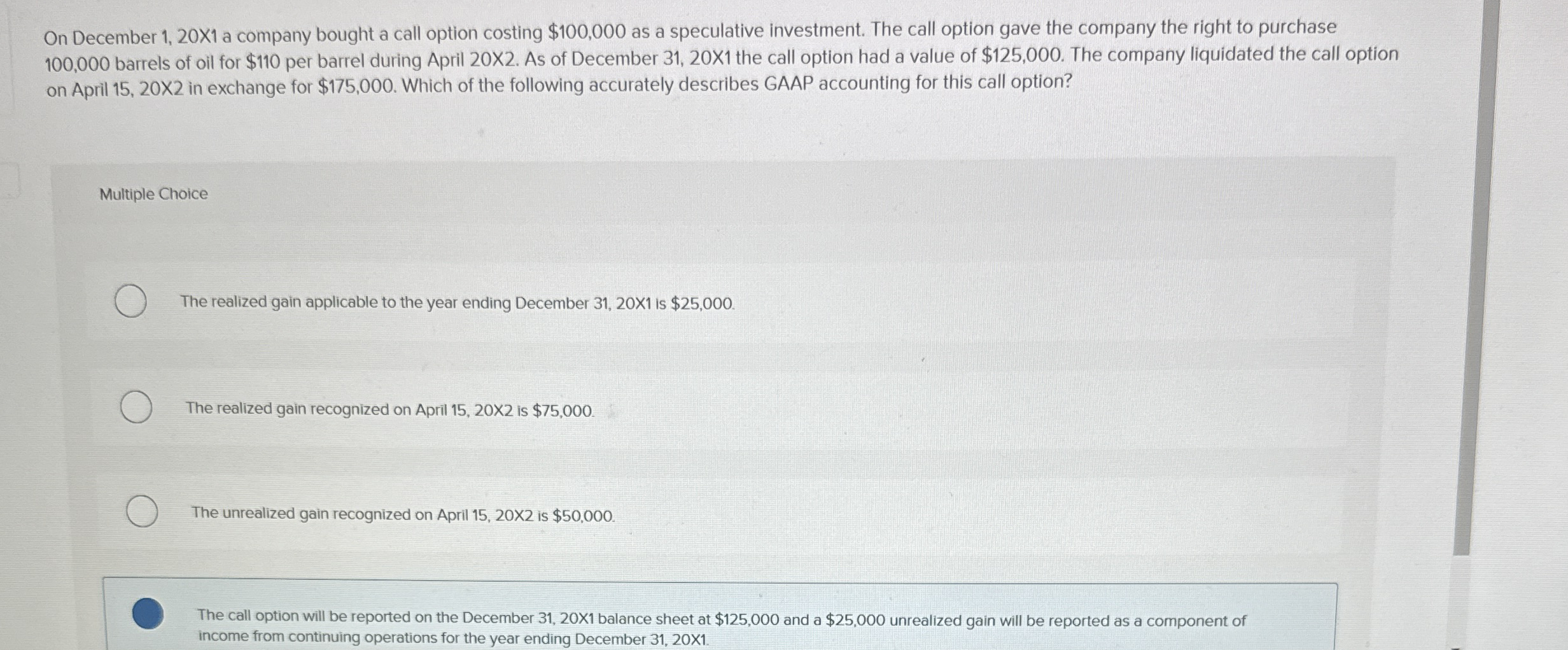

(Solved): On December 1, 20X1 a company bought a call option costing $100,000 as a speculative investment. The ...

On December 1, 20X1 a company bought a call option costing

$100,000as a speculative investment. The call option gave the company the right to purchase 100,000 barrels of oil for

$110per barrel during April 20X2. As of December 31,

20\times 1the call option had a value of

$125,000. The company liquidated the call option on April 15, 20 2 in exchange for

$175,000. Which of the following accurately describes GAAP accounting for this call option? Multiple Choice The realized gain applicable to the year ending December

31,20\times 1is

$25,000. The realized gain recognized on April 15, 20\times 2 is

$75,000. The unrealized gain recognized on April 15, 20X2 is

$50,000. The call option will be reported on the December 31, 20X1 balance sheet at

$125,000and a

$25,000unrealized gain will be reported as a component of income from continuing operations for the year ending December 31, 20X1.