(Solved): Overhead Variances, Four-Variance Analysis, Journal Entries Laughlin, Inc., uses a standard costing ...

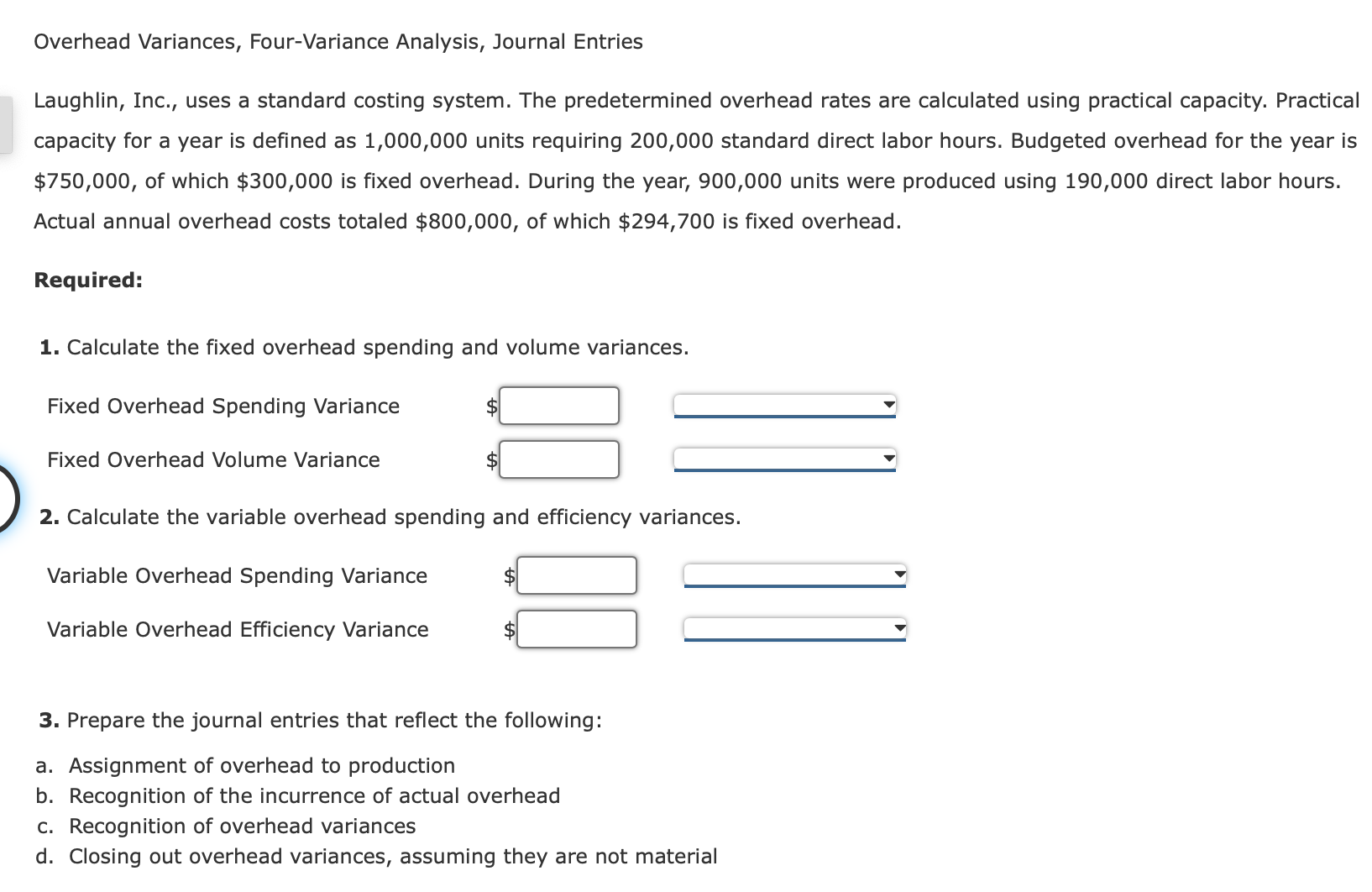

Overhead Variances, Four-Variance Analysis, Journal Entries Laughlin, Inc., uses a standard costing system. The predetermined overhead rates are calculated using practical capacity. Practical capacity for a year is defined as

1,000,000units requiring 200,000 standard direct labor hours. Budgeted overhead for the year is

$750,000, of which

$300,000is fixed overhead. During the year, 900,000 units were produced using 190,000 direct labor hours. Actual annual overhead costs totaled

$800,000, of which

$294,700is fixed overhead. Required: Calculate the fixed overhead spending and volume variances. Fixed Overhead Spending Variance Calculate the variable overhead spending and efficiency variances. Variable Overhead Spending Variance

$Variable Overhead Efficiency Variance

$Prepare the journal entries that reflect the following: a. Assignment of overhead to production b. Recognition of the incurrence of actual overhead c. Recognition of overhead variances d. Closing out overhead variances, assuming they are not material