Home /

Expert Answers /

Finance /

part-a-for-each-of-the-two-capital-structure-options-outline-below-please-calculate-the-followin-pa682

(Solved): Part (a) For each of the two capital structure options outline below, please calculate the followin ...

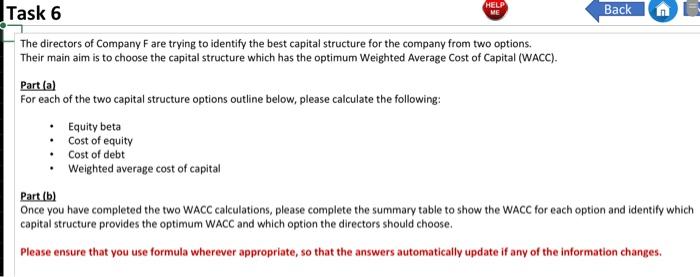

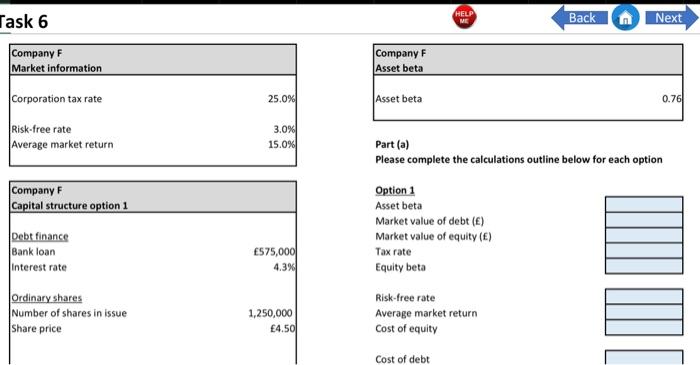

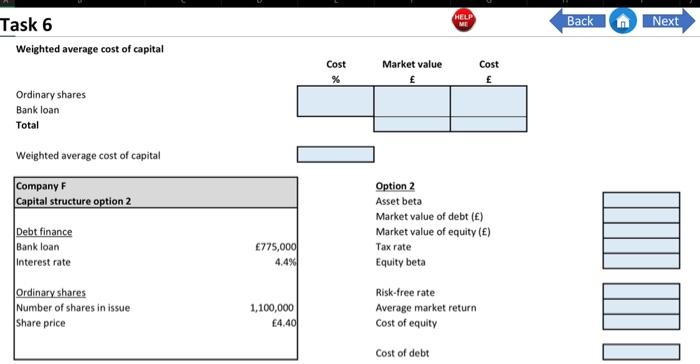

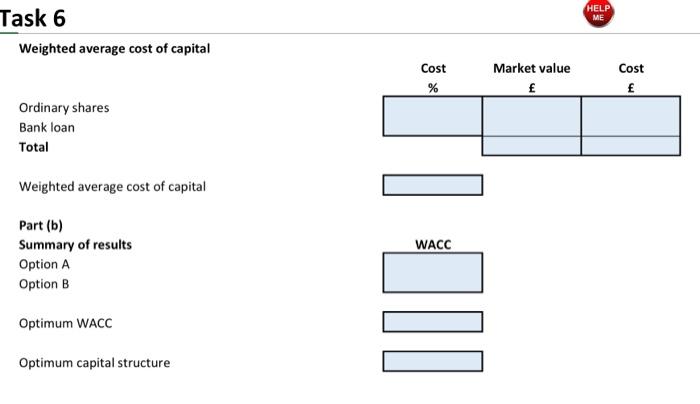

Part (a) For each of the two capital structure options outline below, please calculate the following: - Equity beta - Cost of equity - Cost of debt - Weighted average cost of capital Part (b) Once you have completed the two WACC calculations, please complete the summary table to show the WACC for each option and identify which capital structure provides the optimum WACC and which option the directors should choose. Please ensure that you use formula wherever appropriate, so that the answers automatically update if any of the information changes.

Task 6 Back Part (a) Please complete the calculations outline below for each option

Task 6 Back (n) Next Weighted average cost of capital Ordinary shares Bank loan Total \begin{tabular}{|c|c|c|} \hline Cost & Market value & \multicolumn{1}{c}{ Cost } \\ \( \% \) & \( \mathbf{E} \) & \( \mathbf{E} \) \\ \hline & & \\ & & \\ \hline & & \\ \hline \end{tabular} Weighted average cost of capital \begin{tabular}{|l|} \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} \begin{tabular}{|l|} \hline \\ \hline \\ \hline \end{tabular}

Task 6 Weighted average cost of capital Ordinary shares Bank loan Total \begin{tabular}{|c|c|c|} \multicolumn{1}{c}{ Cost Market value } & Cost \\ \( \% \) & \( \mathbf{E} \) & \( \mathbf{E} \) \\ \hline & & \\ & & \\ \hline \multicolumn{1}{c|}{} & & \\ \hline \end{tabular} Weighted average cost of capital Part (b) Summary of results WACC Option A Option B Optimum WACC Optimum capital structure

Expert Answer

Solution: As per given data, Asset beta = 0.76 Market value of debt = 575000 market value of equity = number of shares * share price =1250000x 4.5 = 5