(Solved): Problem 1-2 You have decided to start a business selling elephants. You form a corporation, Ernie's ...

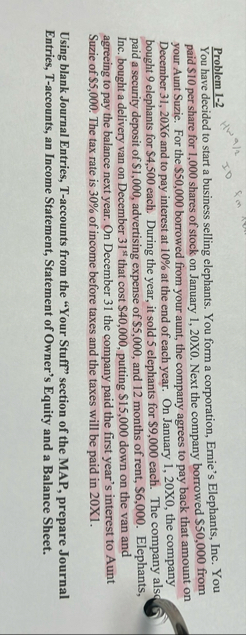

Problem 1-2 You have decided to start a business selling elephants. You form a corporation, Ernie's Elephants, Inc. You paid

$10per share for 1,000 shares of stock on January 1, 20X0. Next the company borrowed

$50,000from your Aunt Suzie. For the

$50,000borrowed from your aunt, the company agrees to pay back that amount on December 31,20X6 and to pay interest at

10%at the end of each year. On January 1,20X0, the company bought 9 elephants for

$4,500each. During the year, it sold 5 elephants for

$9,000each. The company also paid a security deposit of

$1,000, advertising expense of

$5,000, and 12 months of rent,

$6,000. Elephants, Inc. bought a delivery van on December

31^(st )that cost

$40,000, putting

$15,000down on the van and agreeing to pay the balance next year. On December 31 the company paid the first year's interest to Aunt Suzie of

$5,000. The tax rate is

30%of income before taxes and the taxes will be paid in 20X1. Using blank Journal Entries, T-accounts from the "Your Stuff" section of the MAP, prepare Journal Entries, T-accounts, an Income Statement, Statement of Owner's Equity and a Balance Sheet.