Home /

Expert Answers /

Finance /

problem-21-6-macrs-depreciation-and-leasing-you-work-for-a-nuclear-research-laboratory-that-is-conte-pa740

(Solved): Problem 21-6 MACRS Depreciation and Leasing You work for a nuclear research laboratory that is conte ...

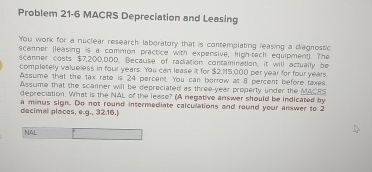

Problem 21-6 MACRS Depreciation and Leasing You work for a nuclear research laboratory that is contemplating leasing a oldgnostic scanner lleasing is a common practice with expensive, frightech equipment. The sconner costs

$7,200,000. Because of raclation contamination it will actually be completely valueless in four years. You can lease it for

$2.115,000per year for four years. Assume that the tax rate is 24 percent. You can borrow at 8 percent before taxes Assume that the scanner will be depreciated os three-yedr property under the MACRS depreciation. What is the NAL or the lease? (A negative answer should be indicated by a minus sign. Do not round intermedinte calculations and round your answer to 2 decimal places, e.g., 32.16.)