Home /

Expert Answers /

Economics /

problem-5-a-construction-company-is-planning-to-complete-a-soil-compaction-process-within-10-years-pa380

(Solved): PROBLEM 5 A construction company is planning to complete a soil compaction process within 10 years. ...

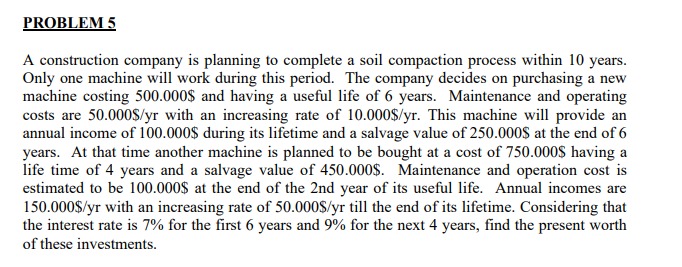

PROBLEM 5

A construction company is planning to complete a soil compaction process within 10 years.

Only one machine will work during this period. The company decides on purchasing a new

machine costing 500.000 $ and having a useful life of 6 years. Maintenance and operating

costs are 50.000($)/(y)r with an increasing rate of 10.000($)/(y)r. This machine will provide an

annual income of 100.000$ during its lifetime and a salvage value of 250.000$ at the end of 6

years. At that time another machine is planned to be bought at a cost of 750.000$ having a

life time of 4 years and a salvage value of 450.000$. Maintenance and operation cost is

estimated to be 100.000$ at the end of the 2nd year of its useful life. Annual incomes are

150.000($)/(y)r with an increasing rate of 50.000($)/(y)r till the end of its lifetime. Considering that

the interest rate is 7% for the first 6 years and 9% for the next 4 years, find the present worth

of these investments.