(Solved): Question 1 ( 5 marks) You have recently completed your studies and plan to launch a perfume retail b ...

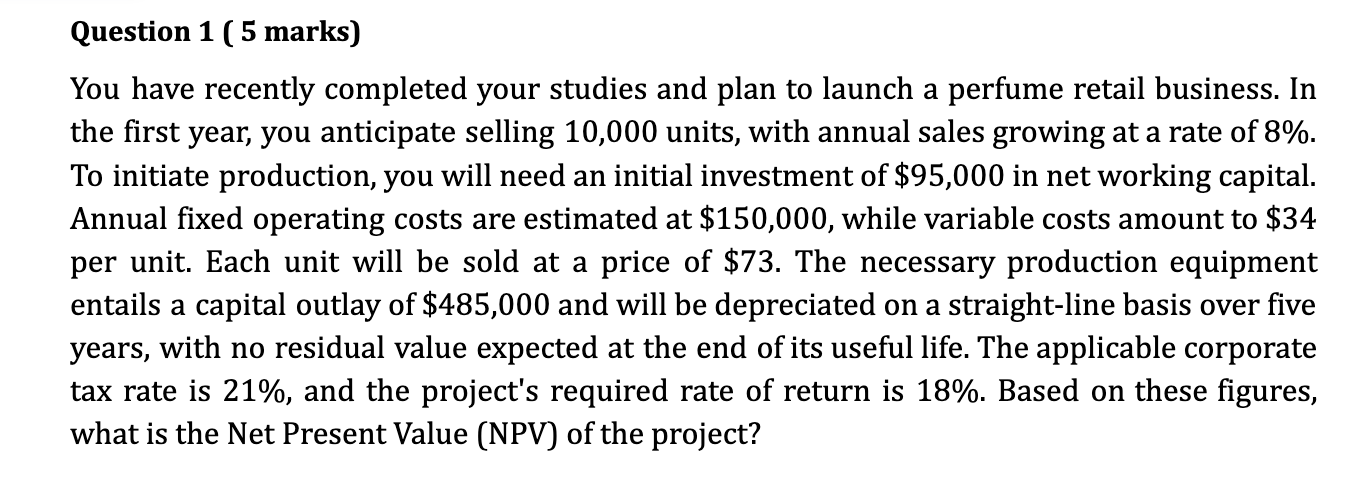

Question 1 ( 5 marks) You have recently completed your studies and plan to launch a perfume retail business. In the first year, you anticipate selling 10,000 units, with annual sales growing at a rate of \( 8 \% \). To initiate production, you will need an initial investment of \( \$ 95,000 \) in net working capital. Annual fixed operating costs are estimated at \( \$ 150,000 \), while variable costs amount to \( \$ 34 \) per unit. Each unit will be sold at a price of \( \$ 73 \). The necessary production equipment entails a capital outlay of \( \$ 485,000 \) and will be depreciated on a straight-line basis over five years, with no residual value expected at the end of its useful life. The applicable corporate tax rate is \( 21 \% \), and the project's required rate of return is \( 18 \% \). Based on these figures, what is the Net Present Value (NPV) of the project?