Home /

Expert Answers /

Accounting /

question-1-of-5-policies-current-attempt-in-progress-on-february-1-monty-company-purchased-490-shar-pa219

(Solved): Question 1 of 5 Policies Current Attempt in Progress On February 1, Monty Company purchased 490 shar ...

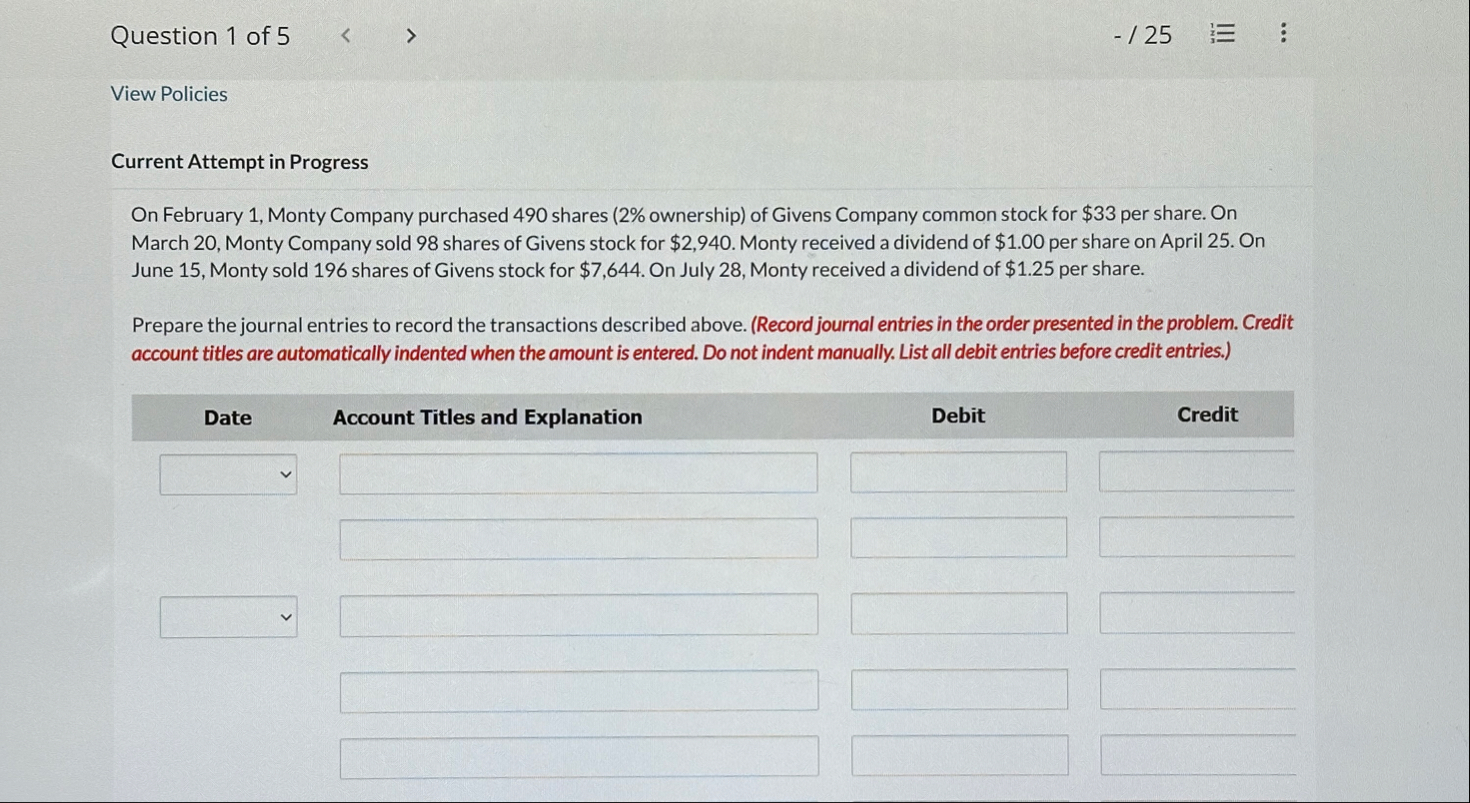

Question 1 of 5 Policies Current Attempt in Progress On February 1, Monty Company purchased 490 shares (

2%ownership) of Givens Company common stock for

$33per share. On March 20, Monty Company sold 98 shares of Givens stock for

$2,940. Monty received a dividend of

$1.00per share on April 25. On June 15, Monty sold 196 shares of Givens stock for $7,644. On July 28, Monty received a dividend of $1.25 per share. Prepare the journal entries to record the transactions described above. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) \table[[Date,Account Titles and Explanation,Debit,Credit],[

?,

?,

?,

?