Home /

Expert Answers /

Finance /

question-2-suppose-that-a-two-factor-model-where-the-factors-are-the-market-return-factor-1-and-pa713

(Solved): Question 2. Suppose that a two-factor model, where the factors are the market return (Factor 1) and ...

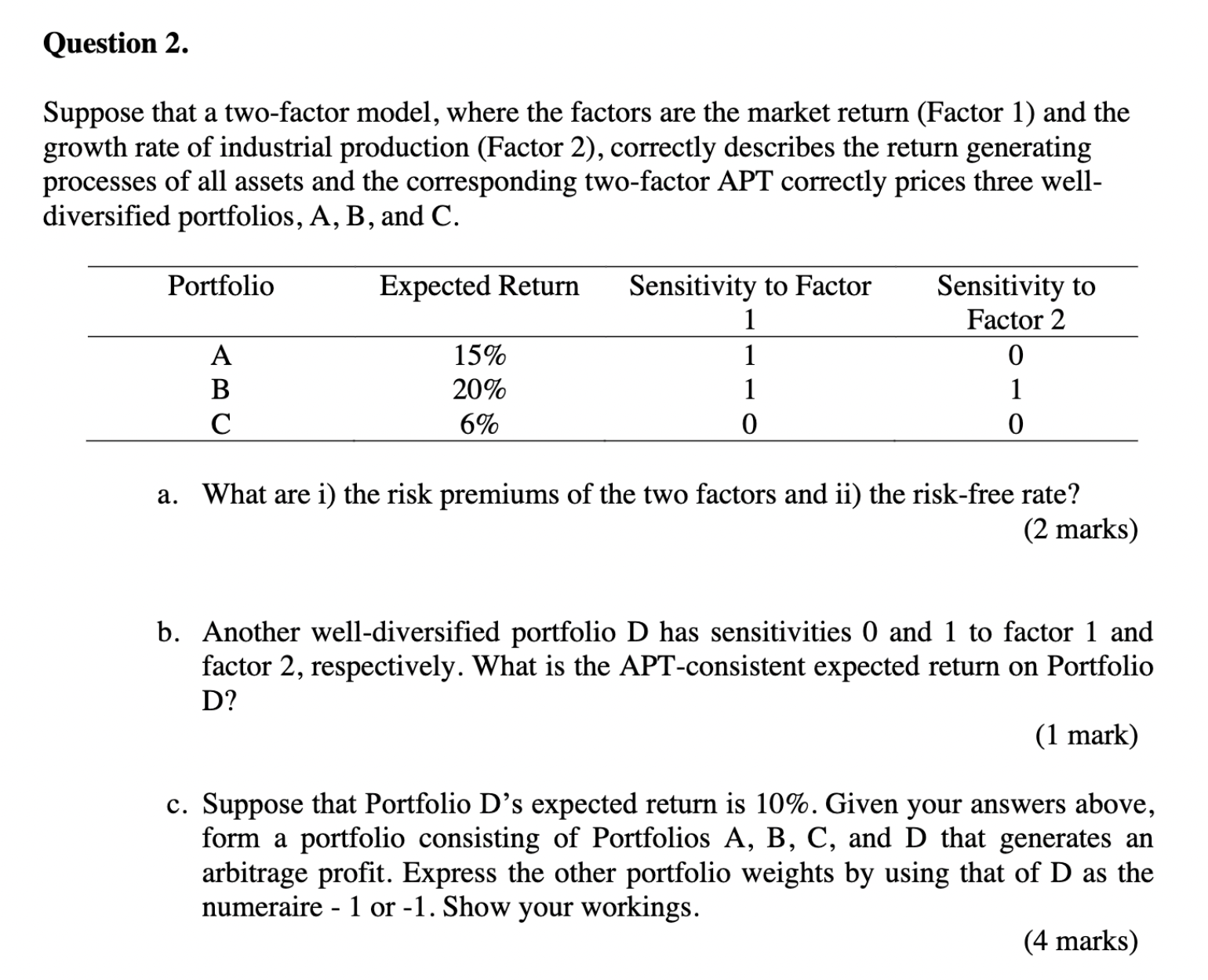

Question 2. Suppose that a two-factor model, where the factors are the market return (Factor 1) and the growth rate of industrial production (Factor 2), correctly describes the return generating processes of all assets and the corresponding two-factor APT correctly prices three welldiversified portfolios, A, B, and C. a. What are i) the risk premiums of the two factors and ii) the risk-free rate? (2 marks) b. Another well-diversified portfolio D has sensitivities 0 and 1 to factor 1 and factor 2, respectively. What is the APT-consistent expected return on Portfolio D? (1 mark) c. Suppose that Portfolio D's expected return is . Given your answers above, form a portfolio consisting of Portfolios A, B, C, and D that generates an arbitrage profit. Express the other portfolio weights by using that of as the numeraire -1 or -1 . Show your workings. (4 marks)