(Solved): Question 2 (Total: 30 marks) Use your 8-digit Student ID as the parameter x, and x_(1),x_(2),x_(3) ...

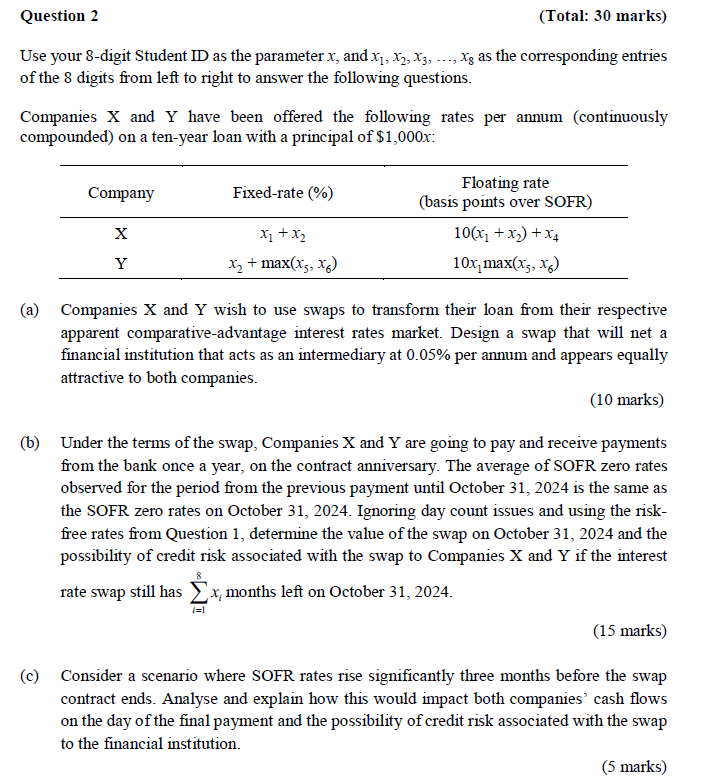

Question 2 (Total: 30 marks) Use your 8-digit Student ID as the parameter x, and x_(1),x_(2),x_(3),dots,x_(8) as the corresponding entries of the 8 digits from left to right to answer the following questions. Companies X and Y have been offered the following rates per annum (continuously compounded) on a ten-year loan with a principal of $1,000 x : (a) Companies X and Y wish to use swaps to transform their loan from their respective apparent comparative-advantage interest rates market. Design a swap that will net a financial institution that acts as an intermediary at 0.05% per annum and appears equally attractive to both companies. (10 marks) (b) Under the terms of the swap, Companies X and Y are going to pay and receive payments from the bank once a year, on the contract anniversary. The average of SOFR zero rates observed for the period from the previous payment until October 31, 2024 is the same as the SOFR zero rates on October 31, 2024. Ignoring day count issues and using the risk- free rates from Question 1, determine the value of the swap on October 31, 2024 and the possibility of credit risk associated with the swap to Companies X and Y if the interest rate swap still has sum_(i=1)^(8)x_(i) months left on October 31, 2024. (c) Consider a scenario where SOFR rates rise significantly three months before the swap contract ends. Analyse and explain how this would impact both companies' cash flows on the day of the final payment and the possibility of credit risk associated with the swap to the financial institution. x=23000128