Home /

Expert Answers /

Economics /

question-21-2-5-pts-add-a-tax-to-a-good-with-an-elastic-demand-and-consumers-end-up-carrying-the-bu-pa360

(Solved): Question 21 2.5 pts Add a tax to a good with an elastic demand and: Consumers end up carrying the bu ...

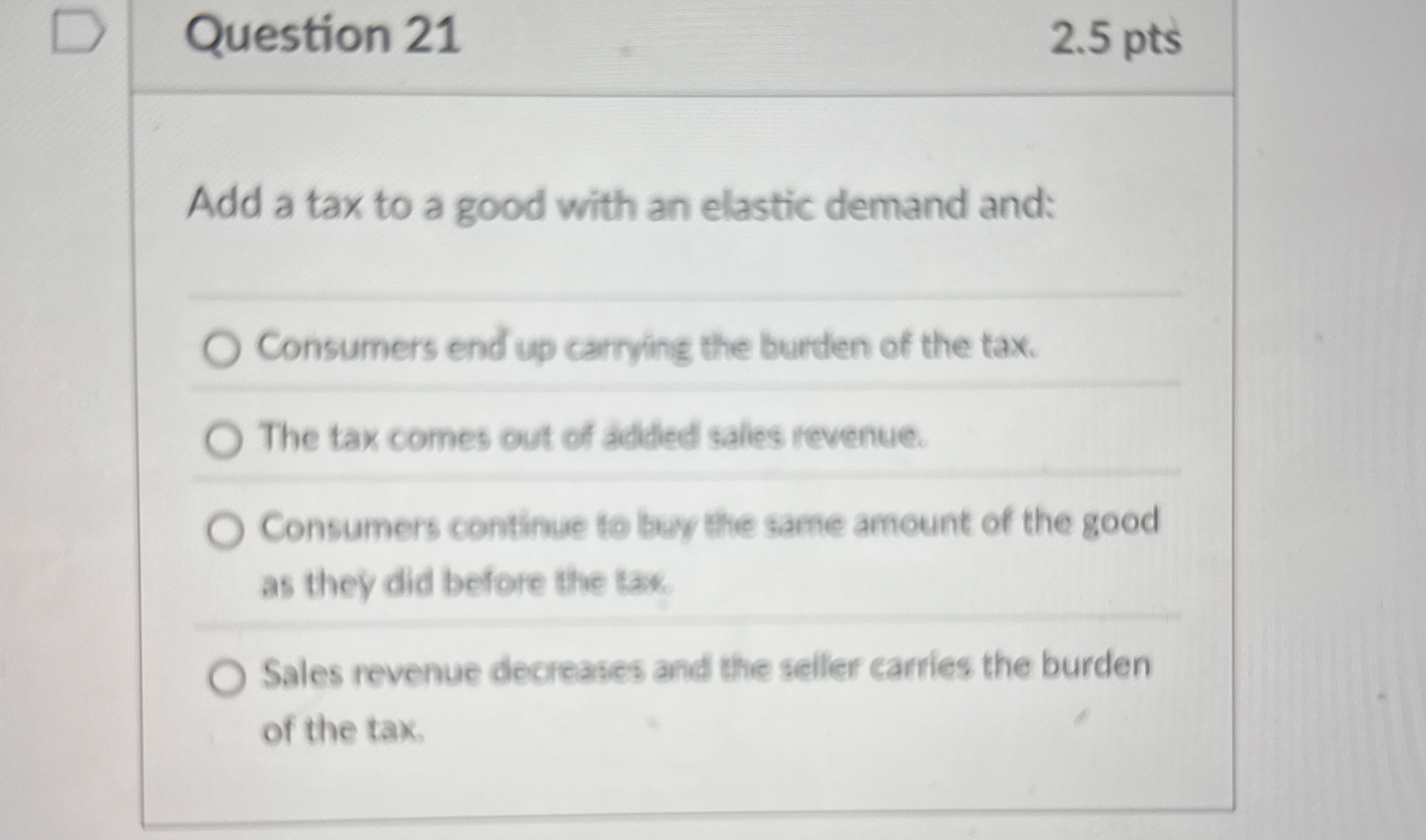

Question 21 2.5 pts Add a tax to a good with an elastic demand and: Consumers end up carrying the burden of the tax. The tax comes out of added salies revenue. Consumers continue to buy the same amount of the good as they did before the tas. Sales revenue decreases and the seller carries the burden of the tax.