(Solved): QUESTION 5 (20 MARKS) (a) Identify TWO (2) components of an option contract: (2 marks) (b) Determine ...

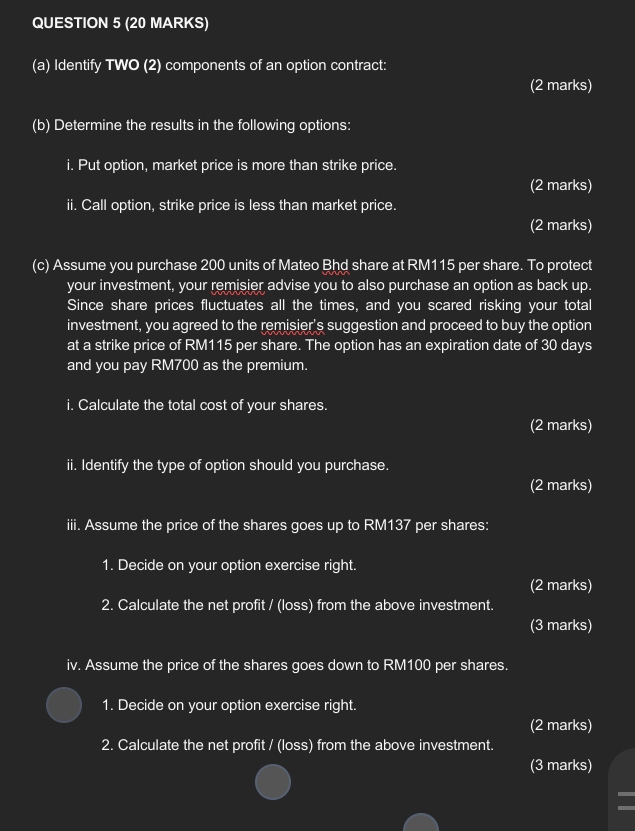

QUESTION 5 (20 MARKS) (a) Identify TWO (2) components of an option contract: (2 marks) (b) Determine the results in the following options: i. Put option, market price is more than strike price. ii. Call option, strike price is less than market price. (2 marks) (2 marks) (c) Assume you purchase 200 units of Mateo Bhd share at RM115 per share. To protect your investment, your remisier advise you to also purchase an option as back up. Since share prices fluctuates all the times, and you scared risking your total investment, you agreed to the remisier's suggestion and proceed to buy the option at a strike price of RM115 per share. The option has an expiration date of 30 days and you pay RM700 as the premium. i. Calculate the total cost of your shares. (2 marks) ii. Identify the type of option should you purchase. (2 marks) iii. Assume the price of the shares goes up to RM137 per shares: Decide on your option exercise right. (2 marks) Calculate the net profit / (loss) from the above investment. (3 marks) iv. Assume the price of the shares goes down to RM100 per shares. Decide on your option exercise right. (2 marks) Calculate the net profit / (loss) from the above investment. (3 marks)