Home /

Expert Answers /

Finance /

requirement-1-a-bond-with-maturity-of-two-years-has-the-foll-owing-cash-flows-by-the-end-of-the-fi-pa185

(Solved): Requirement 1: A bond with maturity of two years has the foll owing cash flows: by the end of the fi ...

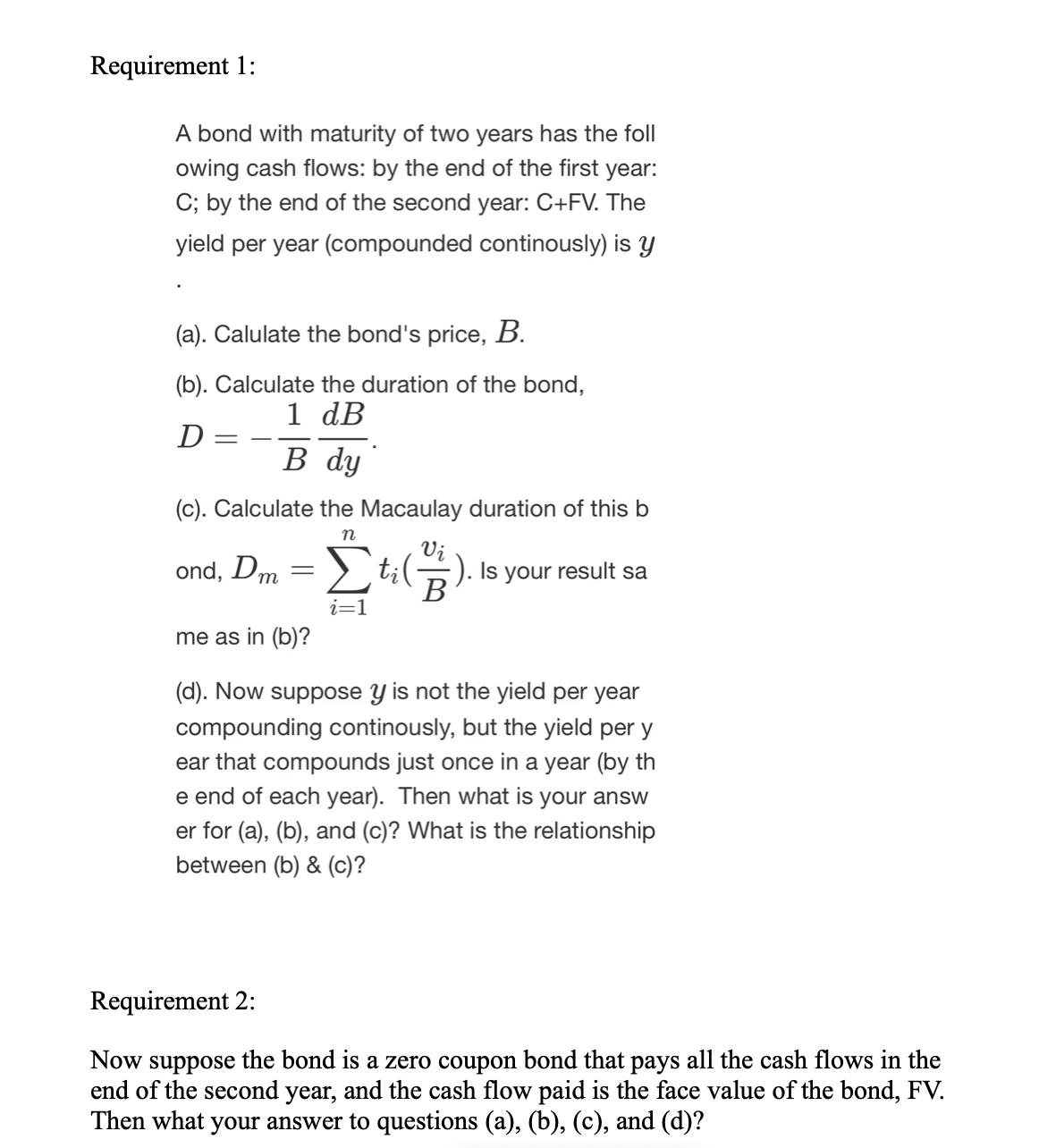

Requirement 1:

A bond with maturity of two years has the foll

owing cash flows: by the end of the first year:

C ; by the end of the second year: C+FV. The

yield per year (compounded continously) is y

(a). Calulate the bond's price, B.

(b). Calculate the duration of the bond,

D=-(1)/(B)(dB)/(dy)

(c). Calculate the Macaulay duration of this b

ond, D_(m)=\sum_(i=1)^n t_(i)((v_(i))/(B)). Is your result sa

me as in (b)?

(d). Now suppose y is not the yield per year

compounding continously, but the yield per y

ear that compounds just once in a year (by th

e end of each year). Then what is your answ

er for (a), (b), and (c)? What is the relationship

between (b) & (c)?

Requirement 2:

Now suppose the bond is a zero coupon bond that pays all the cash flows in the

end of the second year, and the cash flow paid is the face value of the bond, FV.

Then what your answer to questions (a), (b), (c), and (d)? Requirement 2:

Now suppose the bond is a zero coupon bond that pays all the cash flows in the end of the second year, and the cash flow paid is the face value of the bond, FV. Then what your answer to questions (a), (b), (c), and (d)?